コレクション discount bond yield to maturity formula 102393-Bond yield to maturity formula excel

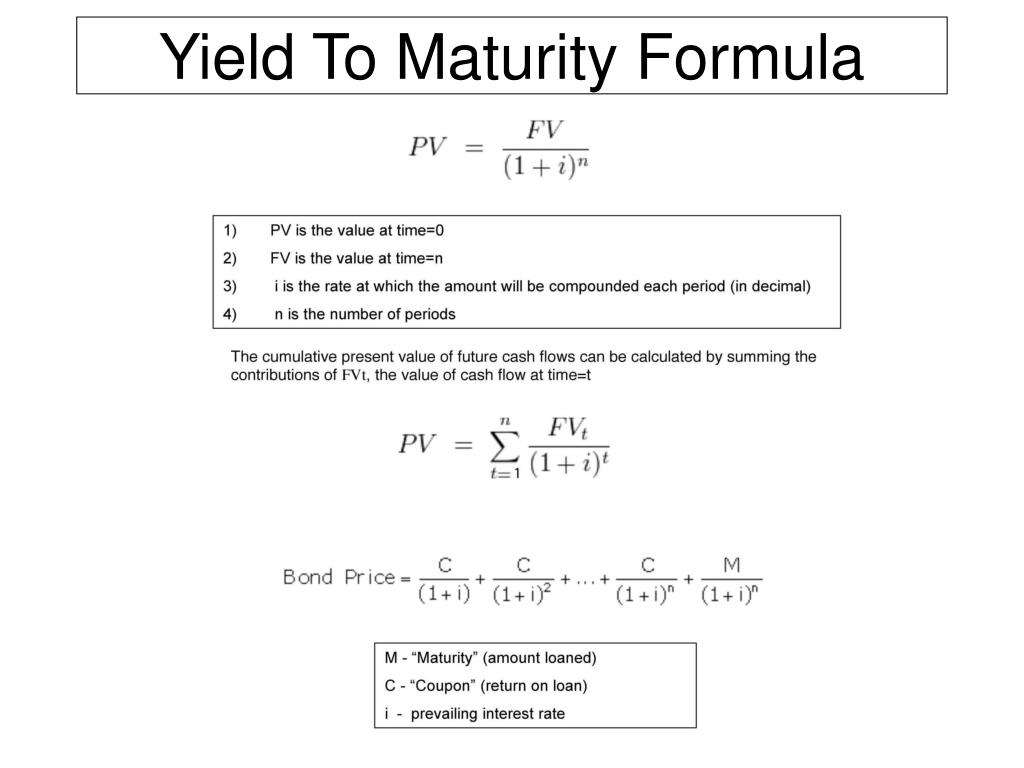

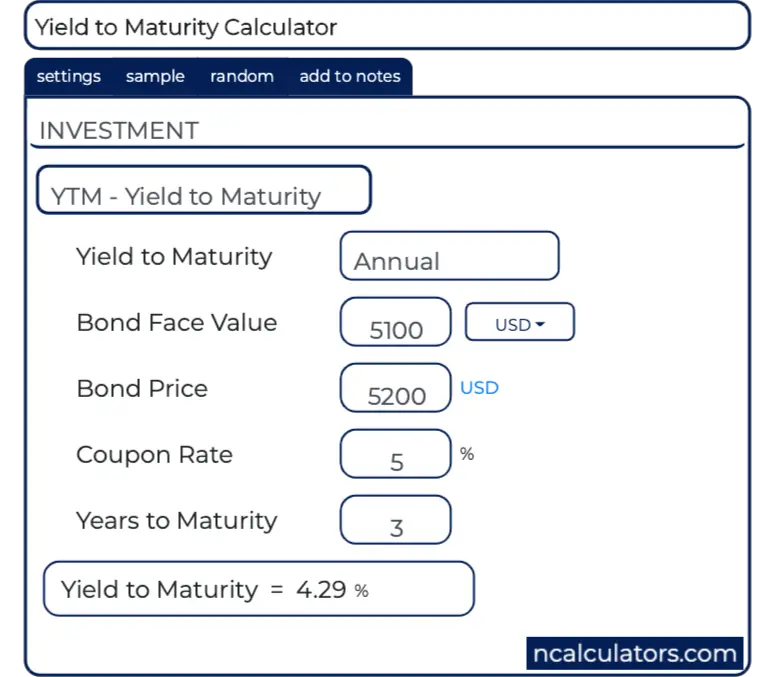

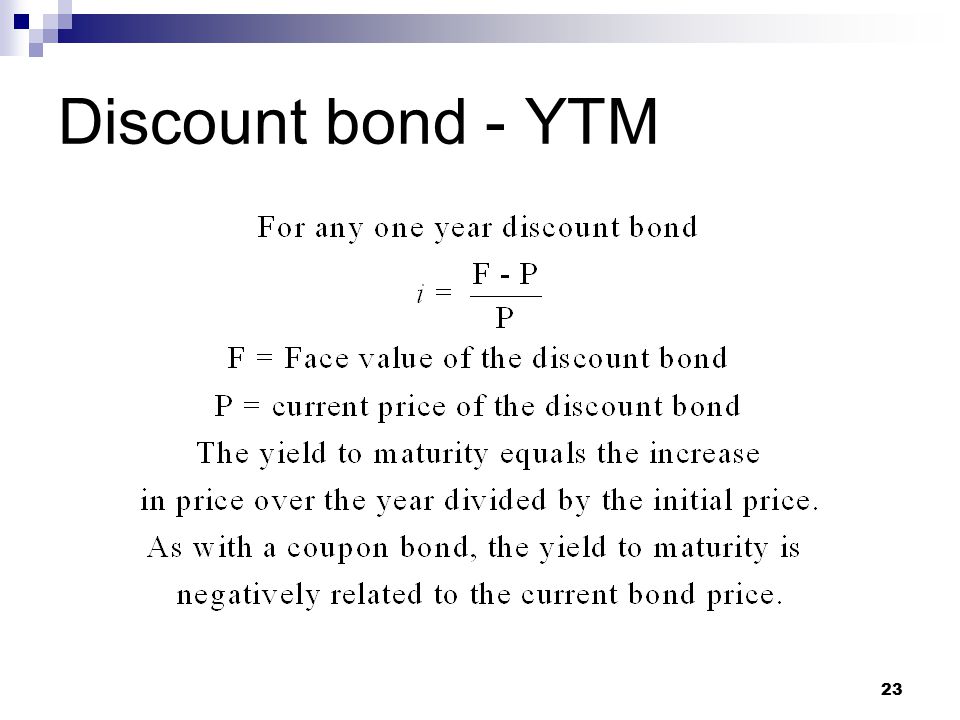

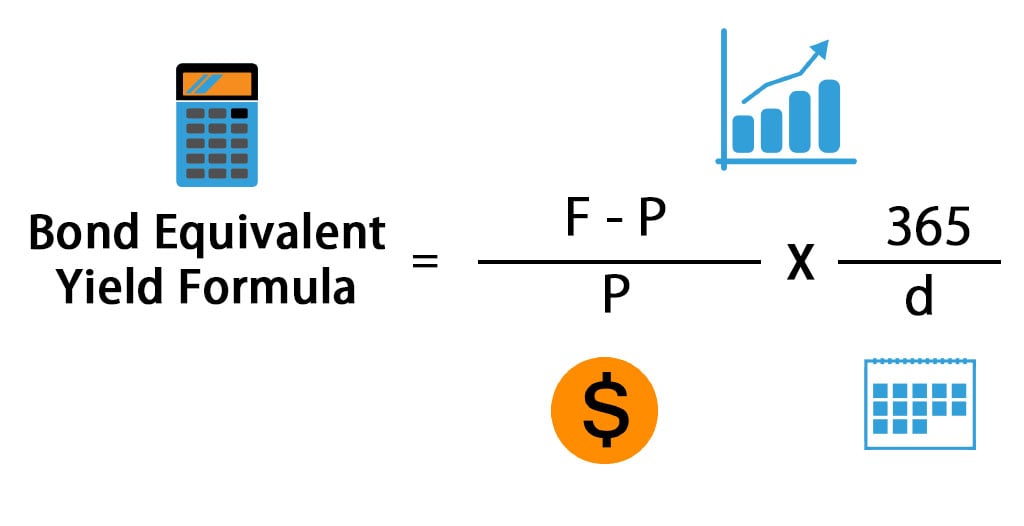

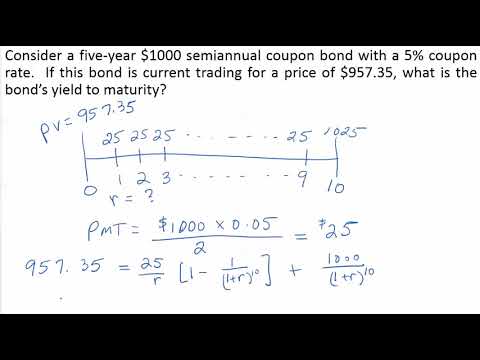

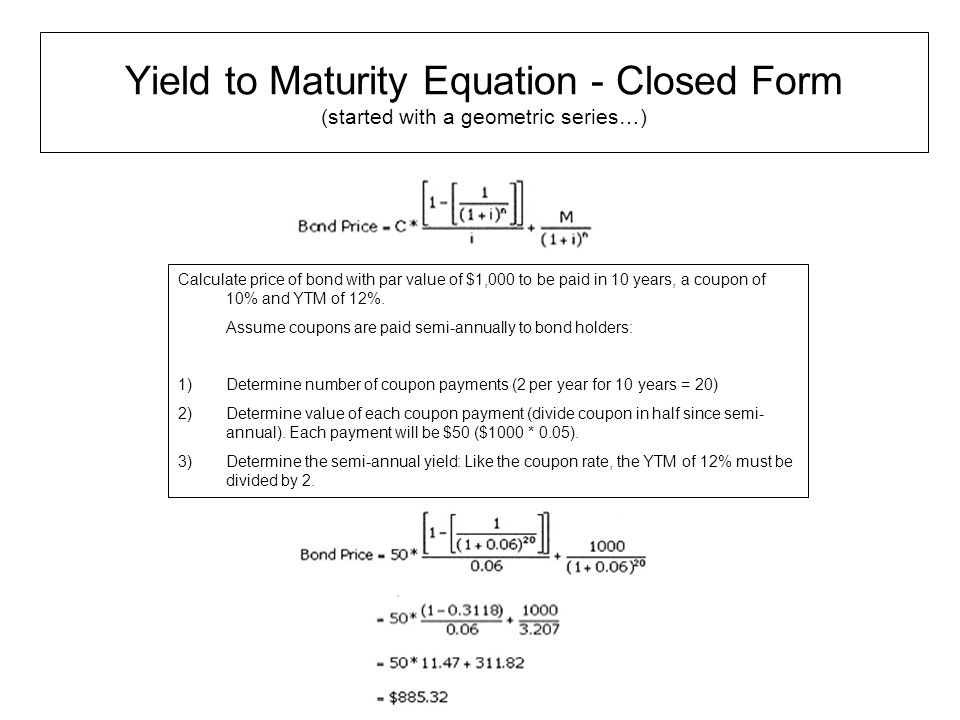

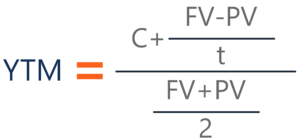

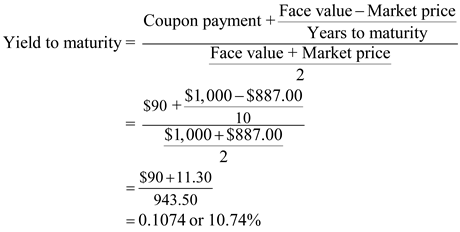

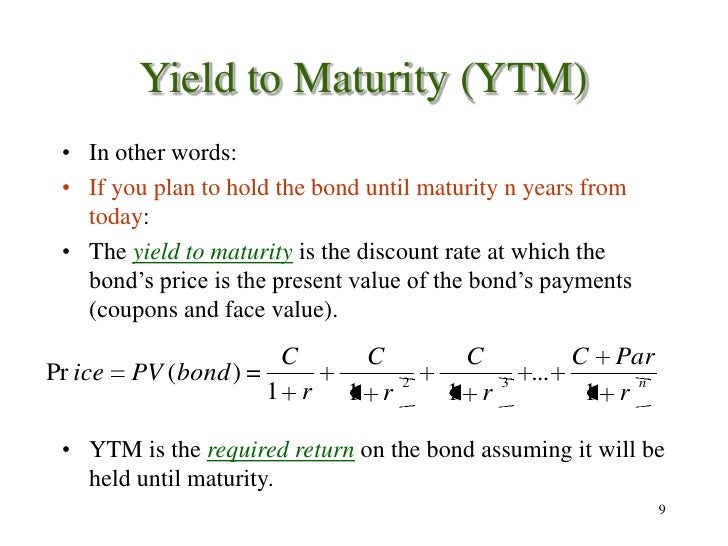

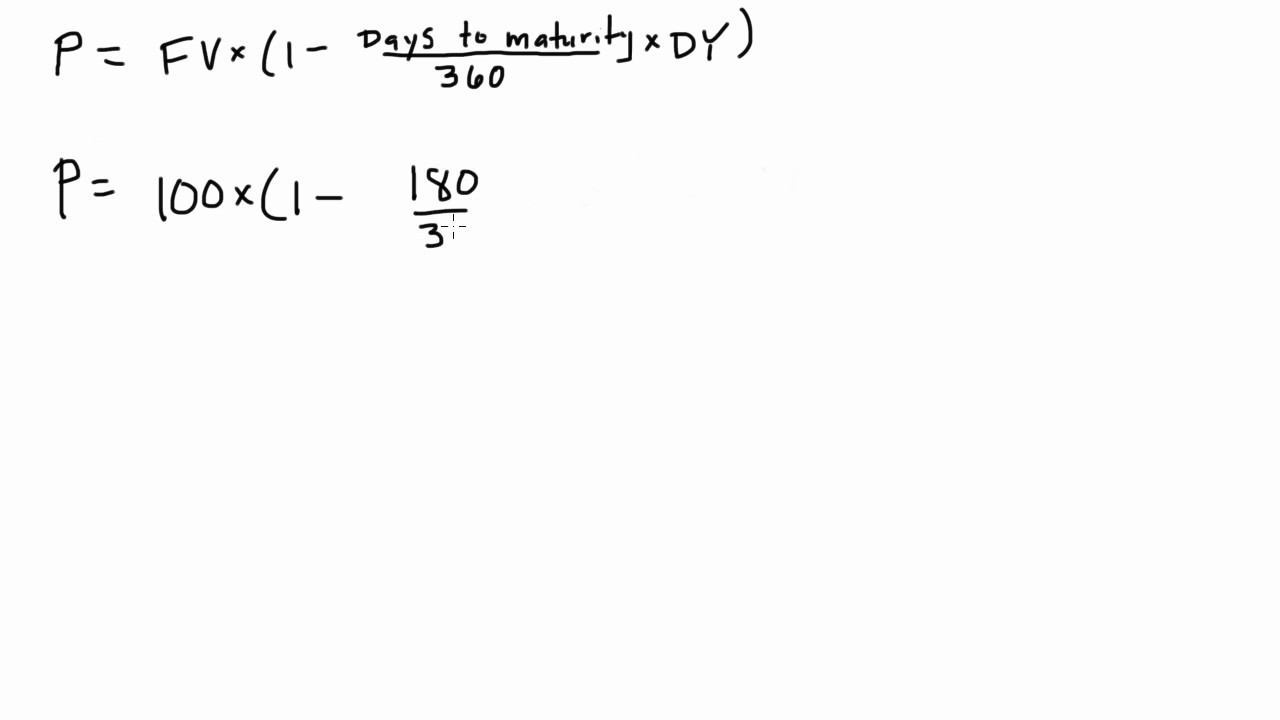

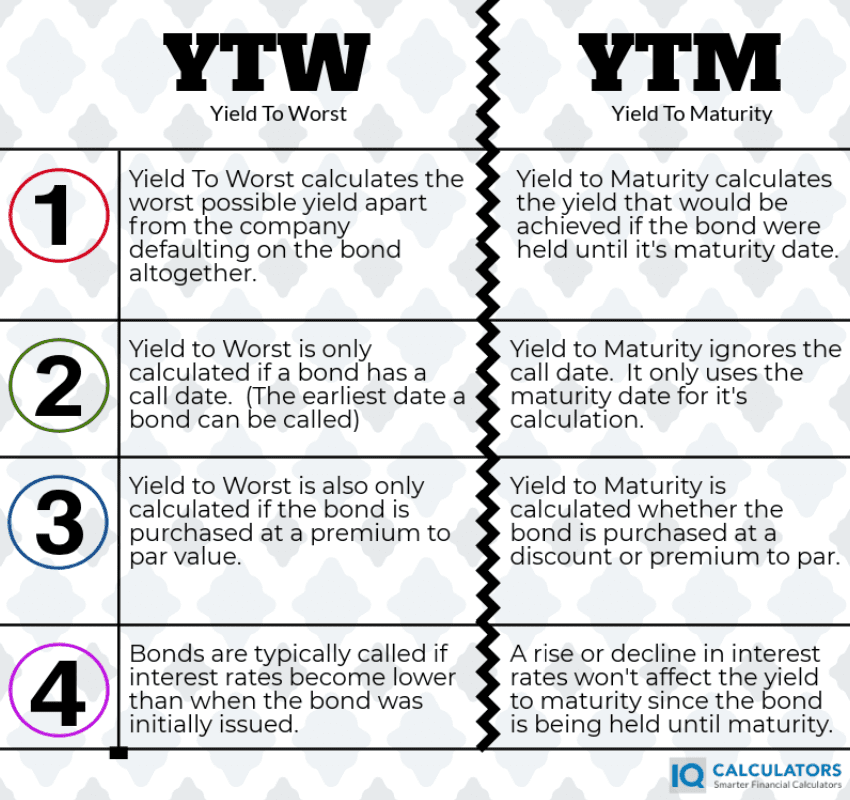

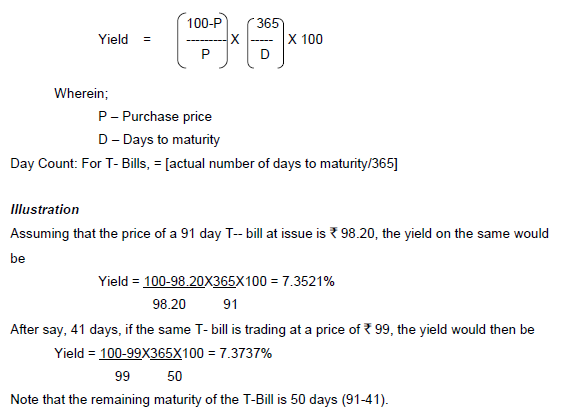

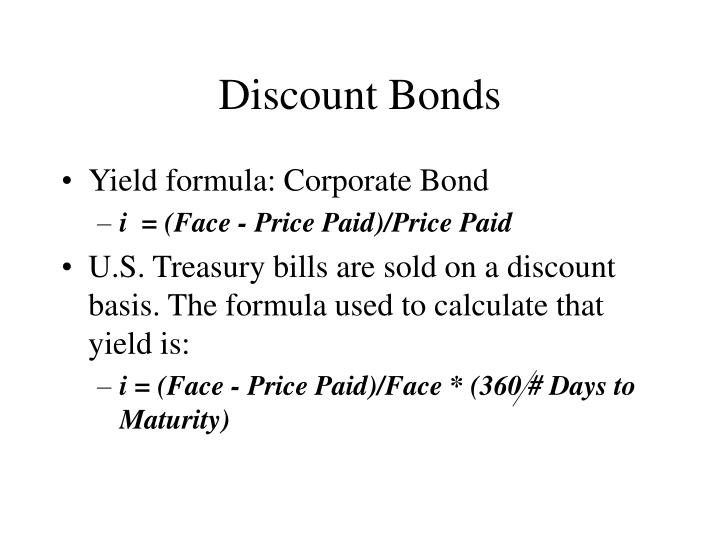

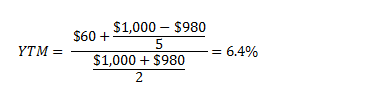

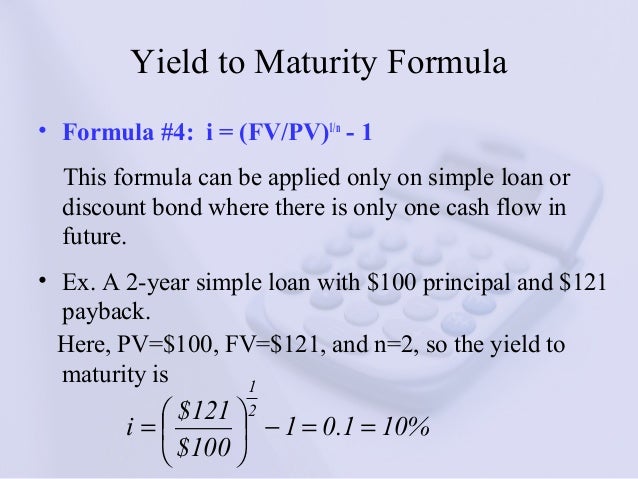

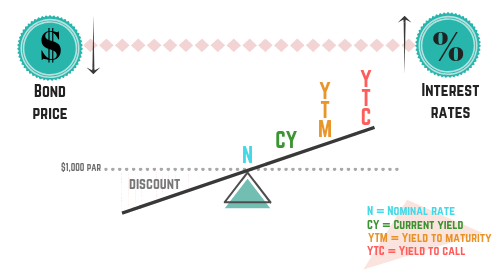

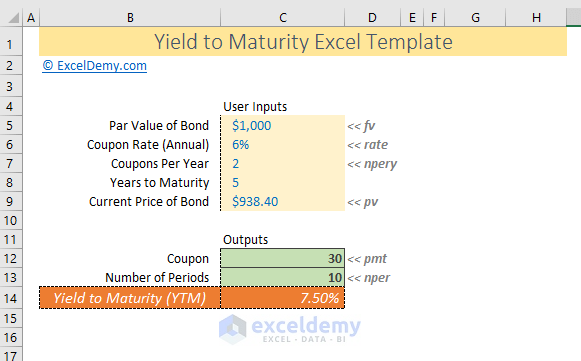

The components of the discount yield formula are as follows (Face Value – Purchase Price) is the total discount amount applied to the face value of the bond (Face Value – Purchase Price) / Face Value is the percentage value of the total discount on the bond to its face value 360 / No of Days (or Months) to Maturity is the number of days (or months) remaining until maturity, because the bond is held until maturityYield to Maturity (YTM) 28 The Yield to maturity (or Promised yield or Internal rate of return (IRR)) can be computed from bond pricing formulas 1 when a bond's price is known (Solve for i ) YTM will be realised when bond is held to maturity Coupon payments are reinvested at the same rate as the YTMYield to Maturity (YTM) for a bond is the total return, interest plus capital gain, obtained from a bond held to maturity It is expressed as a percentage and tells investors what their return on investment will be if they purchase the bond and hold on to it until the bond issuer pays them back

Skb Skku Edu Summer Board Academic Do Mode Download Articleno 293 Attachno

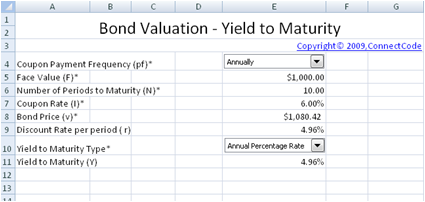

Bond yield to maturity formula excel

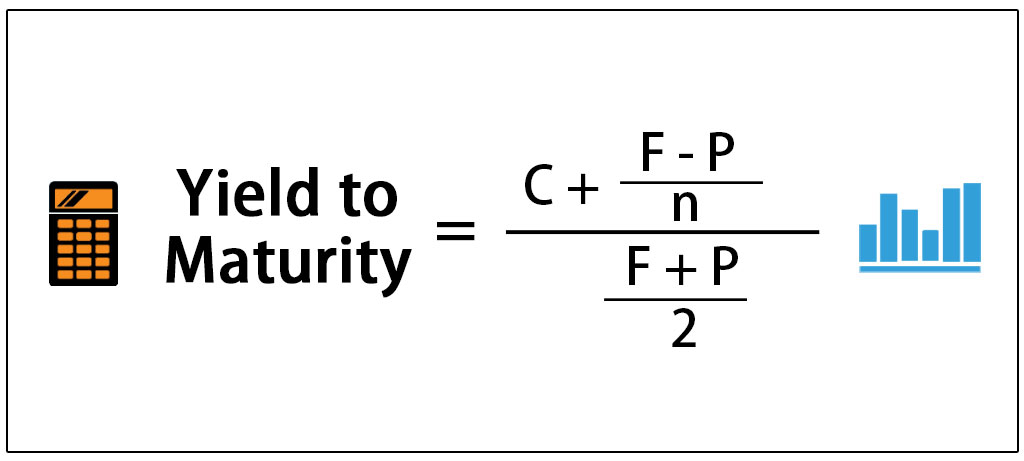

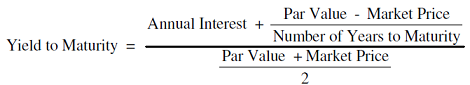

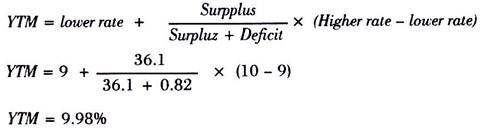

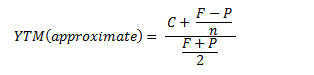

Bond yield to maturity formula excel-Yield to maturity is an important concept for all investors to know A bond's yield to maturity isn't as simple as one might think Read this article to get an in depth perspective on what yield to maturity is, how its calculated, and why its importantThe approximate yield to maturity for the bond is 1333% which is above the annual coupon rate by 3% Using this value as yield to maturity (r), in the present value of the bond formula, would result in the present value to be $;

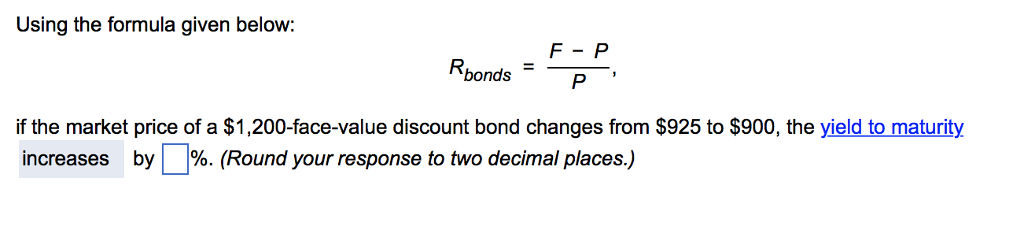

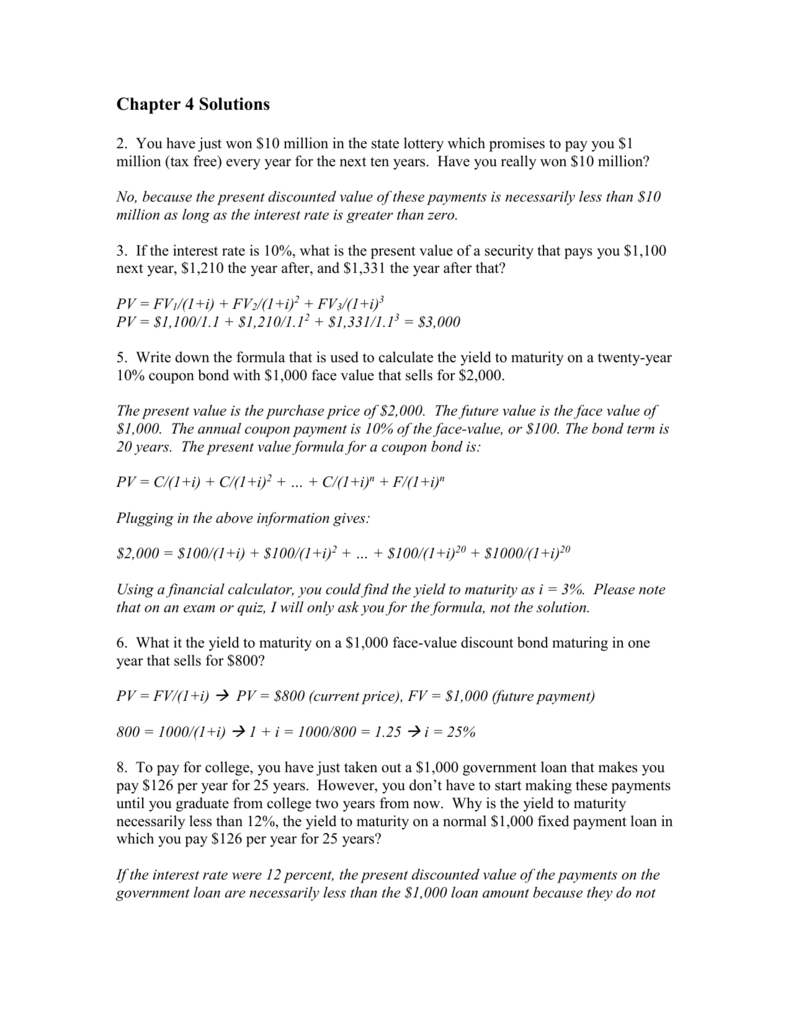

Chapter 4 Solutions

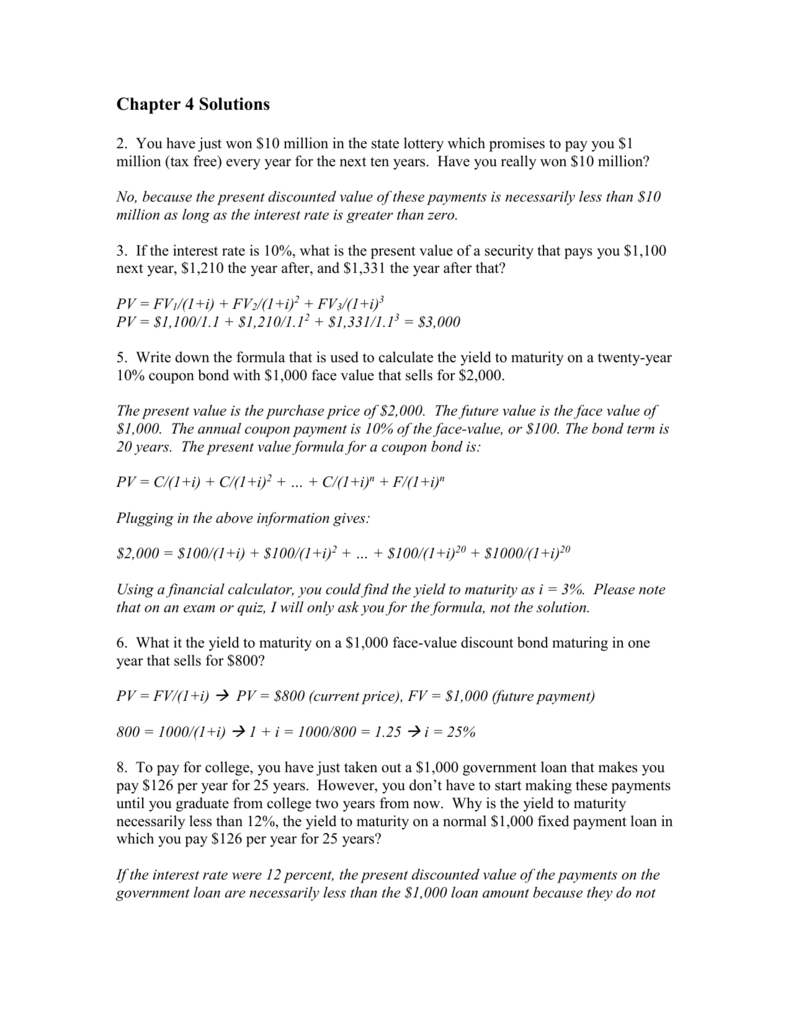

The coupon rate Coupon Rate A coupon rate is the amount of annual interest income paid to a bondholder, based on the face value of the bond for the bond is 15% and the bond will reach maturity in 7 years The formula for determining approximate YTM would look like below The approximated YTM on the bond is 1853% Importance of Yield to MaturityThe most common bond formulas, including time value of money and annuities, bond yields, yield to maturity, and duration and convexity thisMattercom › Money › Bonds This page lists the formulas used in calculations involving money, credit, and bondsAn example Let's say you buy a bond with a face value of $1,000 and a coupon rate of 5%, so the annual interest payments are $50 The bond matures in 10 years, but the issuer can call the bond for

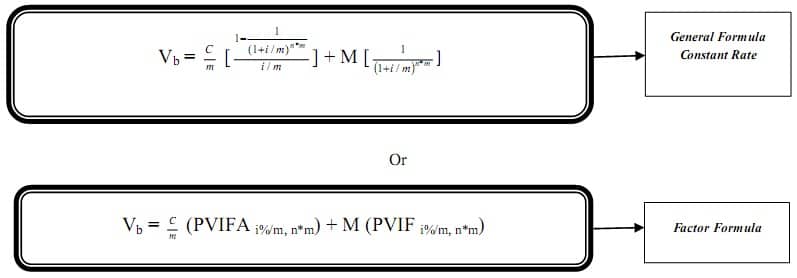

Yield to Maturity (YTM) 28 The Yield to maturity (or Promised yield or Internal rate of return (IRR)) can be computed from bond pricing formulas 1 when a bond's price is known (Solve for i ) YTM will be realised when bond is held to maturity Coupon payments are reinvested at the same rate as the YTMDiscount Margin DM A discount margin (DM) is the average expected return earned in addition to the index underlying , or reference rate, of the floating rate security The size of the discountCoupon Bond Formula – Example #2 Let us take the same example mentioned above In this case, the coupon rate is 5% but to be paid semiannually, while the yield to maturity is currently at 45% Two years have passed since bond issuance and as such there are 8 years left until maturity

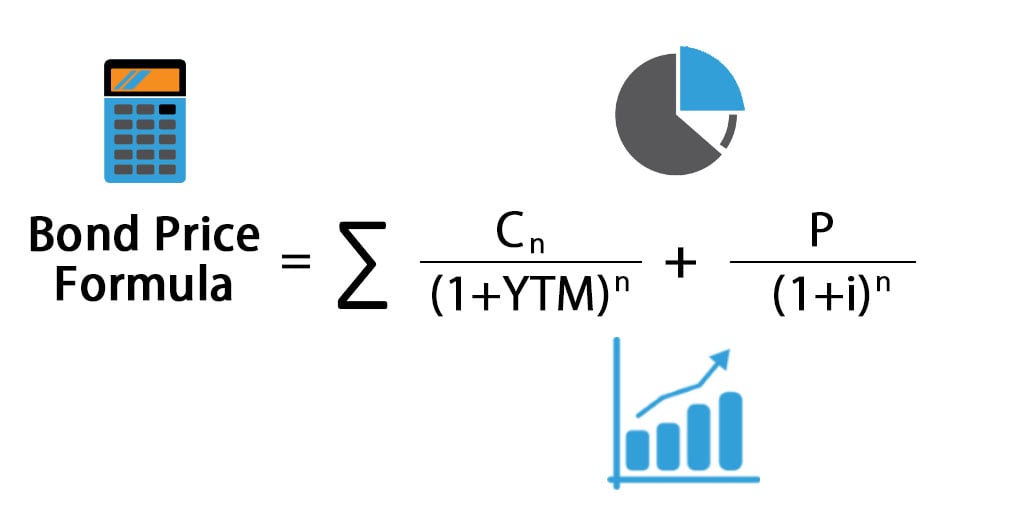

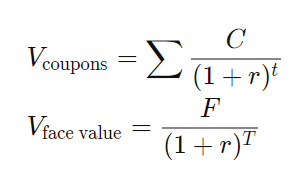

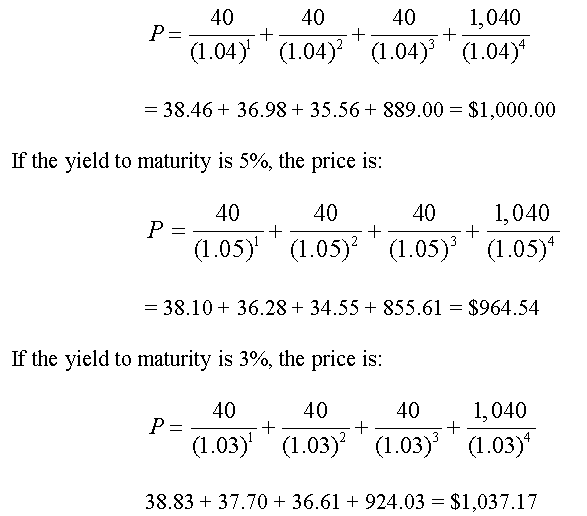

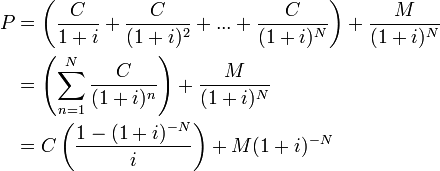

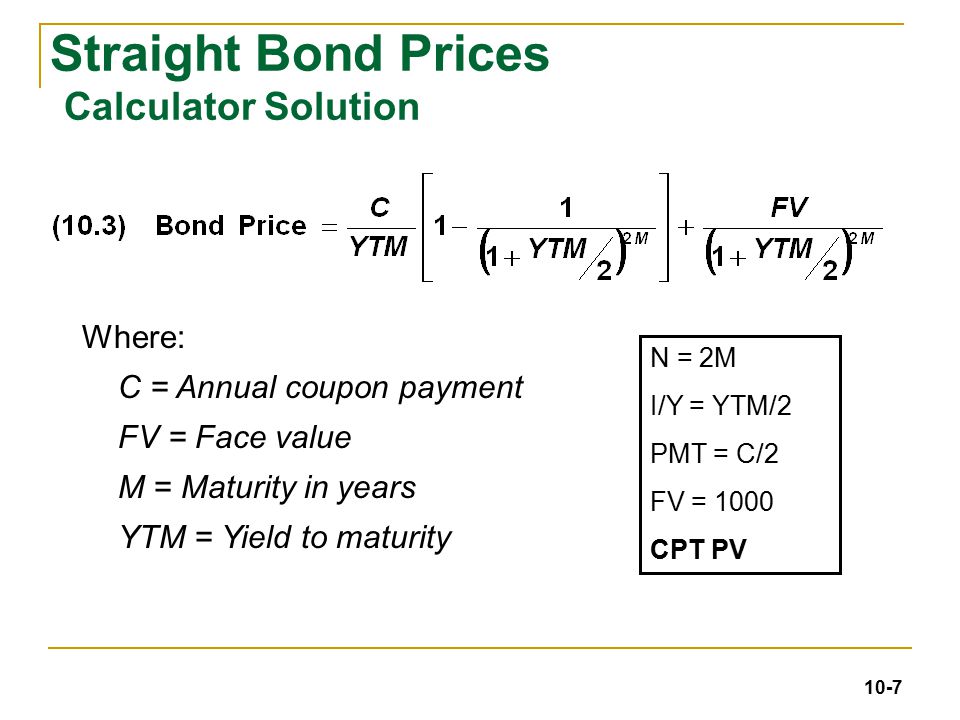

Formula to Calculate Bond Price The formula for bond pricing is basically the calculation of the present value of the probable future cash flows, which comprises of the coupon payments and the par value, which is the redemption amount on maturity The rate of interest which is used to discount the future cash flows is known as the yield to maturity (YTM)Yield to maturity is an important concept for all investors to know A bond's yield to maturity isn't as simple as one might think Read this article to get an in depth perspective on what yield to maturity is, how its calculated, and why its importantIn this case, the discount yield is ($300 discount)/$10,000 par value * 360/1 days to maturity, or a 9% dividend yield The Differences Between Discount Yield and Accretion

Yield To Maturity Ytm Overview Formula And Importance

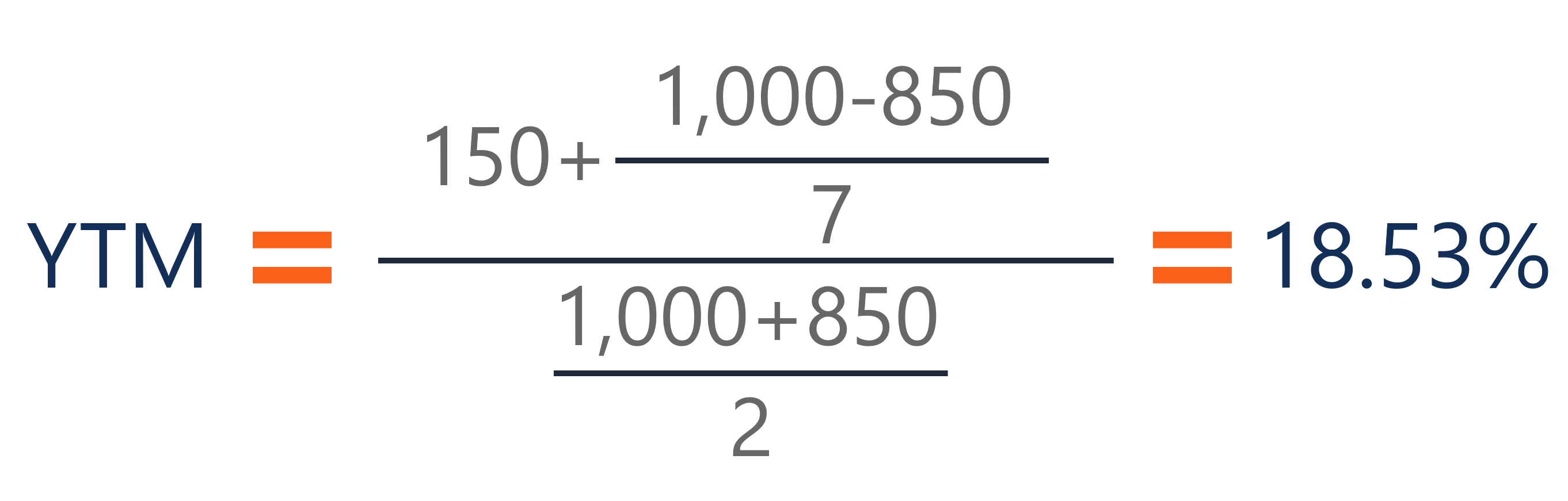

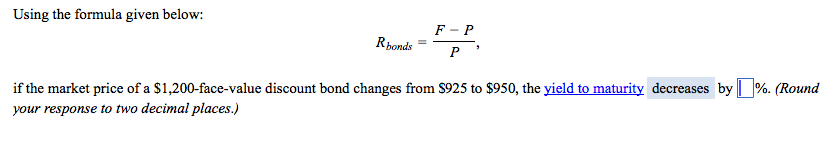

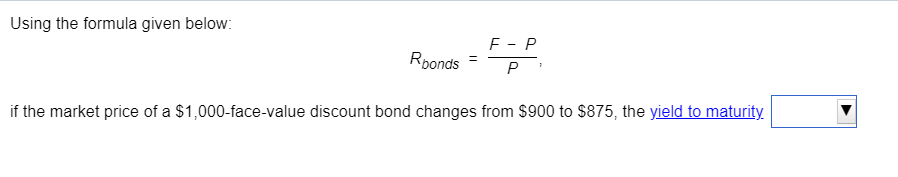

Solved Using The Formula Given Below Rbonds F P P If Chegg Com

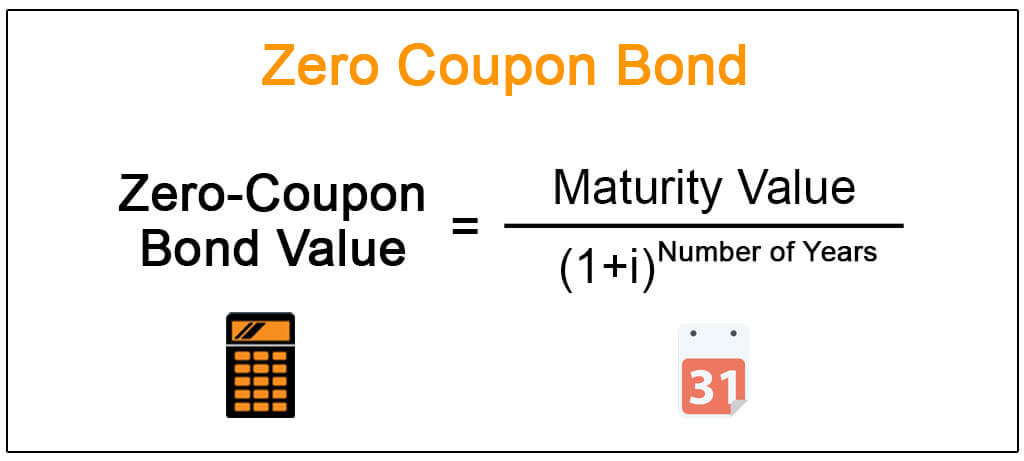

Yield to Maturity Formula, Examples, Conclusion, Calculator COUPON (2 days ago) Yield to maturity (YTM) is the total expected return from a bond when it is held until maturity – including all interest, coupon payments, and premium or discount adjustments The YTM formula is used to calculate the bond's yield in terms of its current market price and looks at the effective yield of a bond(By contrast, a bond discount would enhance, rather than reduce, its yield to maturity) So, the great equalizer is a bond's yield to maturity (YTM) The YTM calculation takes into account the bond's current market price, its par value, its coupon interest rate, and its time to maturityR = Yield to maturity (YTM) and n = No of periods till maturity On the other, the bond valuation formula for deep discount bonds or zerocoupon bonds can be computed simply by discounting the par value to the present value, which is mathematically represented as, ZeroCoupon Bond Price = (as the name suggests, there are no coupon payments)

Coupon Rate Vs Yield Rate For Bonds Wall Street Oasis

Solved Using The Formula Given Below Rbonds If The Market Chegg Com

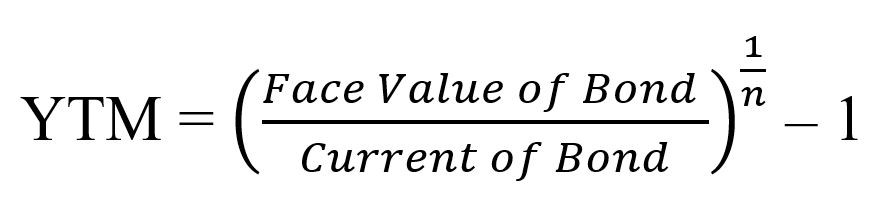

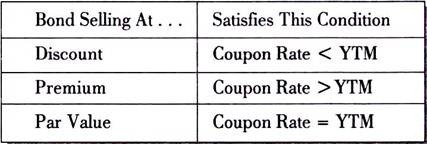

Y T M = Face Value Current Price n − 1 where n = number of years to maturity Face value = bond's maturity value or par value Current price = the bond's price today \begin{aligned} &YTMIn order to calculate the Coupon Equivalent Yield on a Treasury Bill you must first solve for the intermediate variables in the equation In this formula they are addressed as a, b, and c 364 025 (4) a = Calculate Coupon Equivalent Yield For bills of not more than one halfyear to maturity For bills of more than one halfyear to maturity iCorrect answer Option a a discount Explanation If the yieldtomaturity of a bond exceeds the coupon rate offered on the bonds sold by the company, then the bonds will be sold at a discount

Berk Chapter 8 Valuing Bonds

Chapter 4 Solutions

Price of a Bond In pricing a bond, the characteristics of a bond that are considered are the par value, the coupon rate, the yield to maturity, and the term to maturityHowever, YTM is not current yield – yield to maturity is the discount rate which would set all bond cash flows to the current price of the bond You can find more information (including an estimated formula to calculate YTM) on the yield to maturity calculator page Current Yield Formula The bond current yield formula isYield to maturity can be mathematically derived and calculated from the formula YTM is therefore a good measurement gauge for the expected investment return of a bond When it comes to online calculation, this Yield to Maturity calculator can help you to determine the expected investment return of a bond according to the respective input values

Ppt Yield To Maturity Formula Powerpoint Presentation Free Download Id

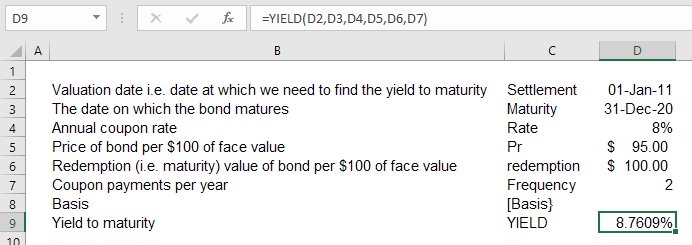

How To Use The Excel Yield Function Exceljet

Yield to Maturity (YTM) Overview, Formula, and Importance COUPON (4 days ago) The coupon rate for the bond is 15% and the bond will reach maturity in 7 years The formula for determining approximate YTM would look like below The approximated YTM on the bond is 1853%P is the price of a bond, C is the periodic coupon payment, r is the yield to maturity (YTM) of a bond, B is the par value or face value of a bond, Y is the number of years to maturity Example 2 Suppose a bond is selling for $980, and has an annual coupon rate of 6% It matures in five years, and the face value is $1000 What is the Yield toCoupon on the bond will be $1,000 * 850% / 2 which is $425, since this pays semiannually Yield to Maturity (Approx) = (4250 (1000 – 9) / (10 * 2))/ ( ( 1000 9 )/2) Yield to Maturity will be –

Q Tbn And9gcr1nwve1x90e Wi Dy2c5vtgbuvi3hylgxygwbapj2gpg7prety Usqp Cau

How To Calculate Bond Prices And Yields On The Series 7 Exam Dummies

Multiply the percentage of discount by the number of times the maturity term occurs in a year Using the same example, the equation would be discount yield = 004 * 147 The discount yield is 758 percent By purchasing a $10,000 Treasury Bill for $9,600, you will earn 758 percent in interestThis is because the bonds are paid in full at maturity Example of Discount Bond Let's take an example of a discount bond Consider a bond listed on NASDAQ, which is currently trading at a discount The coupon rate of the bond is 492 The price at the time of issuance of a bond is $100 The yield at the time of issuance is 492%In order to calculate the Coupon Equivalent Yield on a Treasury Bill you must first solve for the intermediate variables in the equation In this formula they are addressed as a, b, and c 364 025 (4) a = Calculate Coupon Equivalent Yield For bills of not more than one halfyear to maturity For bills of more than one halfyear to maturity i

Yield To Maturity Definition How To Calculate Ytm Pros Cons

Bond Pricing Formula How To Calculate Bond Price

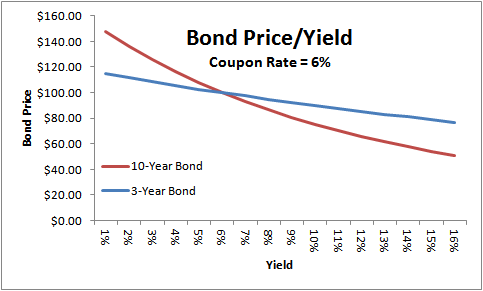

A bond's yield is the return an investor realizes on a bond in percentage terms If a bond pays more than one cash flow (coupon), then there is no direct formula which can be used to calculate the bond's yield Instead, an iterative approach is used This is referred to as the yield to maturity (YTM)Correct answer Option a a discount Explanation If the yieldtomaturity of a bond exceeds the coupon rate offered on the bonds sold by the company, then the bonds will be sold at a discountThis is the most accurate formula because yield to maturity is the interest rate an investor would earn by reinvesting every coupon payment from the bond at a constant rate until the bond reaches maturity If you had a discount bond which does not pay a coupon, you could use the following formula instead YTM = \sqrtn{ \dfrac{Face\ Value}{Current\ Value} } 1 Yield to Maturity Examples The bond has a price of $9 and the face value is $1000 The annual coupons are at a 10% coupon

Yield To Maturity Ytm Calculator

What Is Yield And How Does It Differ From Coupon Rate

Coupon vs Yield to Maturity A bond has a variety of features when it's first issued, including the size of the issue, the maturity date, and the initial couponFor example, the US Treasury might issue a 30year bond in 19 that's due in 49 with a coupon of 2%An example Let's say you buy a bond with a face value of $1,000 and a coupon rate of 5%, so the annual interest payments are $50 The bond matures in 10 years, but the issuer can call the bond forYield to maturity can be mathematically derived and calculated from the formula YTM is therefore a good measurement gauge for the expected investment return of a bond When it comes to online calculation, this Yield to Maturity calculator can help you to determine the expected investment return of a bond according to the respective input values

Lecture 7 Measuring Interest Rate Ppt Video Online Download

Fixed Income Analysis Week 2 Measuring Yields And Returns Ppt Download

The IRR or yield to maturity of the above bond is 609% Discount Factors Based on Yield to Maturity Dividing 1 by 1 plus the yield raised to the power of the number of periods is how we calculated the annual discount factors above These are discount factors based on the bond's yield ( ) ( )(By contrast, a bond discount would enhance, rather than reduce, its yield to maturity) So, the great equalizer is a bond's yield to maturity (YTM) The YTM calculation takes into account the bond's current market price, its par value, its coupon interest rate, and its time to maturityA bond's yield is the return an investor realizes on a bond in percentage terms If a bond pays more than one cash flow (coupon), then there is no direct formula which can be used to calculate the bond's yield Instead, an iterative approach is used This is referred to as the yield to maturity (YTM)

Free Bond Valuation Yield To Maturity Spreadsheet

Yield To Maturity Formula Step By Step Calculation With Examples

The yield to maturity on the bond if it was bought for $ and has a $1100 face value with a coupon rate of 10% is ___% 708% Price of a coupon bond (formula)This price is somewhat close to the current price of the bond, which is $10Spot Interest Rate vs Yield to Maturity Yield to maturity and spot interest rate in case of purediscount bonds ie zerocoupon bonds are the same However, in case of couponpaying bonds, yield to maturity is the (somewhat) weighted average of the individual spot interest rates that apply to each cash flow of the bond

Bond Valuation Overview With Formulas And Examples

How To Calculate Yield To Maturity Definition Equation Example Financial Accounting Class Video Study Com

The term "yield to maturity" or YTM refers to the return expected from a bond over its entire investment period until maturity YTM is used in the calculation of bond price wherein all probable future cash flows (periodic coupon payments and par value on maturity) are discounted to present value on the basis of YTMYield to Maturity (YTM) Overview, Formula, and Importance Provided by corporatefinanceinstitutecom FREE The coupon rate Coupon Rate A coupon rate is the amount of annual interest income paid to a bondholder, based on the face value of the bond for the bond is 15% and the bond will reach maturity in 7 years The formula for determining approximate YTM would look like below TheAn example Let's say you buy a bond with a face value of $1,000 and a coupon rate of 5%, so the annual interest payments are $50 The bond matures in 10 years, but the issuer can call the bond for

Bond Prices Rates And Yields

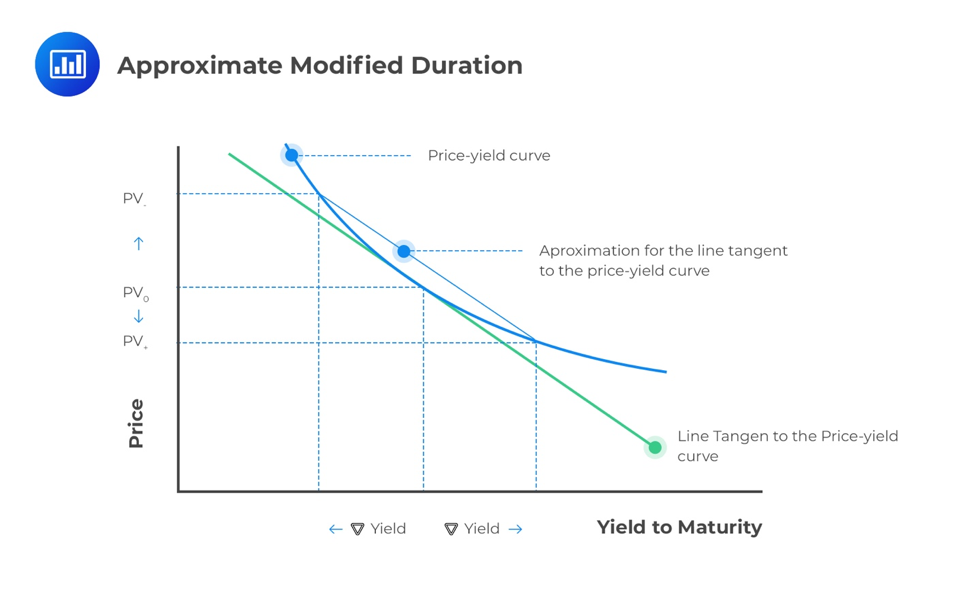

Macaulay Modified And Effective Durations Cfa Level 1 Analystprep

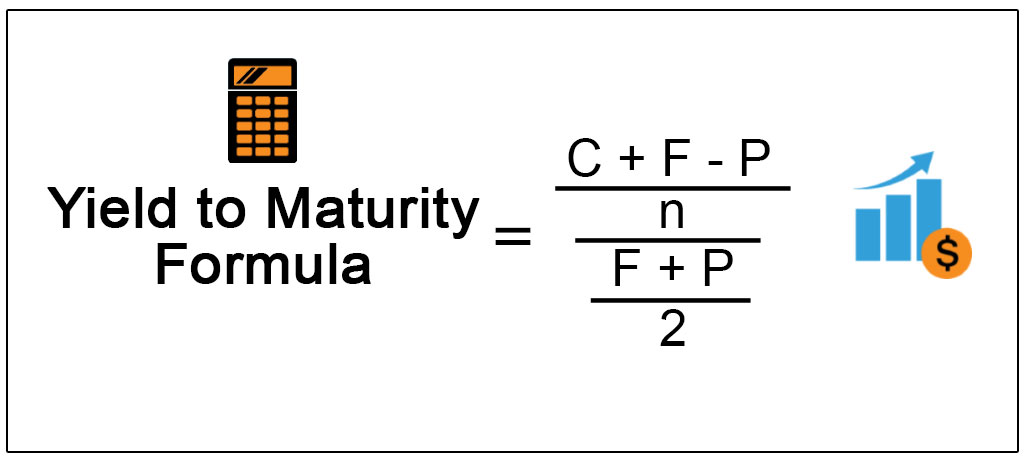

The borrower repays both the principal and interest at the maturity date B Calculate the present value of aa $1,400 discount bond with 55 years to maturity if the yield to maturity is 44 %Hence it is clear that if bond price decrease, bond yield increase Example #3 If a bond has a face value of $1800 and its price s $870 now and the coupon rate is 9%, Find the bond yieldEstimated Yield to Maturity Formula However, that doesn't mean we can't estimate and come close The formula for the approximate yield to maturity on a bond is ( (Annual Interest Payment) ( (Face Value Current Price) / (Years to Maturity) ) ) / ( ( Face Value Current Price ) / 2 ) Let's solve that for the problem we pose by default in

Bond Equivalent Yield Formula Calculator Excel Template

Discount Yield Overview How To Calculate Usage

Yield to Maturity (YTM) Overview, Formula, and Importance CODES (3 days ago) The coupon rate Coupon Rate A coupon rate is the amount of annual interest income paid to a bondholder, based on the face value of the bond for the bond is 15% and the bond will reach maturity in 7 years The formula for determining approximate YTM would look like below The approximated YTM on the bond is 1853%To calculate a bond's yield to maturity, enter the face value (also known as "par value"), coupon rate, number of years to maturity, frequency of payments, and the current price of the bond How to Calculate Yield to Maturity For example, you buy a bond with a $1,000 face value and an 8% coupon for $900Yield to Maturity (YTM) 28 The Yield to maturity (or Promised yield or Internal rate of return (IRR)) can be computed from bond pricing formulas 1 when a bond's price is known (Solve for i ) YTM will be realised when bond is held to maturity Coupon payments are reinvested at the same rate as the YTM

Bonds Spot Rates Vs Yield To Maturity Youtube

Calculate The Ytm Of A Coupon Bond Youtube

Yield To Maturity Formula Ppt Download

D2tomeq9arcjda Cloudfront Net Mf Wp Content Upl

Yield To Maturity Ytm Overview Formula And Importance

Q Tbn And9gctacaieid4sboc7gfwy42ckuxutk9izg3v4wua1wzgqipvknrom Usqp Cau

An Introduction To Bonds Bond Valuation Bond Pricing

Valuing Bonds Boundless Finance

Yield To Maturity

Chapter 5 Solutions Financial Management 13th Edition Chegg Com

Bond Yield Calculator

Yield To Maturity Formula Step By Step Calculation With Examples

Bond Basics Bond Yields Flashcards Quizlet

Zero Coupon Bond Yield Calculator Ytm Of A Discount Bond

Cost Of Debt Definition Formula Calculation Example

Solved Using The Formula Given Below F P Rponds P If The Chegg Com

Calculating Yield To Maturity Of A Zero Coupon Bond

Ch7

Bond Pricing And Accrued Interest Illustrated With Examples

Calculating The Yield To Maturity Ytm Of A Bond Financial Management

How To Calculate Bond Price And Yield To Maturity Pdf Free Download

1

Bond Yield Formula Calculator Example With Excel Template

Quant Bonds Yield

What Is Yield To Maturity How To Calculate It Scripbox

Bond Valuation Wikipedia

Bond Formula How To Calculate A Bond Examples With Excel Template

What Is The Difference Between Irr And The Yield To Maturity The Motley Fool

Treasury Bill Discount Yield Example 1 Youtube

Berk Chapter 8 Valuing Bonds

21 Cfa Level I Exam Cfa Study Preparation

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Current Yield Vs Yield To Maturity

Yield To Worst What It Is And Why It S Important

Term Structure Of Interest Rates Tutorials The Middle Road

Valuing Bonds Boundless Finance

Bond Basics Bond Yields Flashcards Quizlet

Bond Yield Calculator

Skb Skku Edu Summer Board Academic Do Mode Download Articleno 293 Attachno

How To Calculate Yield To Maturity Definition Equation Example Financial Accounting Class Video Study Com

/dotdash_INV_final_Discount_Yield_Jan_2021-01-fc704294a32348a7bc00e0fc7652b88e.jpg)

What Is Discount Yield

Yield To Maturity Approximate Formula With Calculator

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Yield_Oct_2020-01-7b25f37332ff434f9bc3794782fe38fe.jpg)

Current Yield

Reserve Bank Of India

Www Studocu Com En Ca Document University Of Waterloo Money And Banking Summaries Chapter 4 Summary The Economics Of Money Banking And Financial Markets View

What You Must Know On Bond Valuation And Yield To Maturity Acca Afm Got It Pass

Zero Coupon Bond Definition Formula Examples Calculations

Bond Discounting I Types I Examples I Formula I Bonds Valuation

What Is A Zero Coupon Bond

Bonds Yield To Worst Current Yield Vs Yield To Maturity

Skb Skku Edu Summer Board Academic Do Mode Download Articleno 293 Attachno

How To Calculate Yield For A Callable Bond The Motley Fool

Ppt Interest Rates And Returns Some Definitions And Formulas Powerpoint Presentation Id

Calculating The Yield To Maturity Ytm Of A Bond Financial Management

How To Calculate Bond Value 6 Steps With Pictures Wikihow

Calculating The Yield Of A Coupon Bond Using Excel Youtube

How To Calculate Yield To Maturity Definition Equation Example Financial Accounting Class Video Study Com

Bond Basics Bond Yields Flashcards Quizlet

Bond Valuation And Bond Yields P4 Advanced Financial Management Acca Qualification Students Acca Global

Hp 12c Bond Valuation Tvmcalcs Com

What Is The Difference Between Irr And The Yield To Maturity The Motley Fool

How To Calculate The Percentage Return Of A Treasury Bill The Motley Fool

Learning Unit 09 Interest Rate

Bonds Bond Prices Interest Rates And Holding Period Return Ppt Download

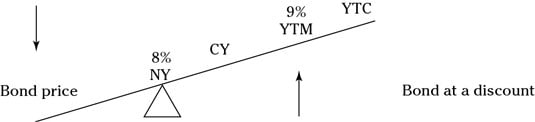

Discount Bond Yield Relationships Yield Bond Fundamentals Achievable

Q Tbn And9gctpp Yhakt6zldckkc4thylaemc1itl Zuuhu5g Pgc4 Aobhyf Usqp Cau

Yield Curve An Overview Sciencedirect Topics

Chapter 10 Bond Prices And Yields 4 19 Ppt Download

Bond Yields Nominal And Current Yield Yield To Maturity Ytm With Formulas And Examples

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Current Yield Vs Yield To Maturity

Yield To Maturity Ytm And Yield To Call Ytc alectures Com

How To Calculate Yield To Maturity 9 Steps With Pictures

Zero Coupon Bond Yield Formula With Calculator

Bond Yield Calculator

Vba To Calculate Yield To Maturity Of A Bond

Www Jstor Org Stable

How To Calculate Yield To Maturity In Excel With Template Exceldemy

:max_bytes(150000):strip_icc()/dotdash_Final_Yield_to_Worst_YTW_Oct_2020-01-cabc0d0cf5b64ef0b4f72afb4888b3aa.jpg)

Yield To Worst Ytw Definition

Yield To Maturity Fixed Income

Chapter 11 Bond Yields And Prices Ppt Video Online Download

Yield To Maturity Ytm Definition Formula And Example

コメント

コメントを投稿