【印刷可能】 yield to maturity calculator excel download 873090-Yield to maturity calculator excel download

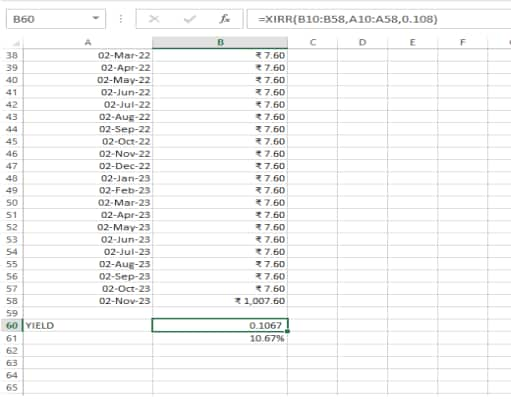

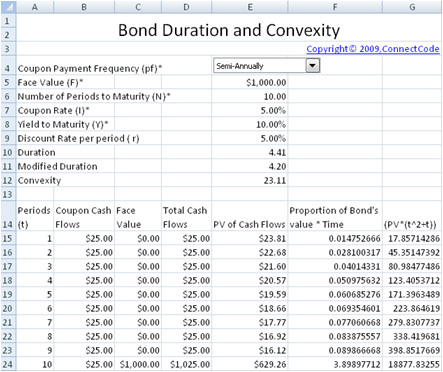

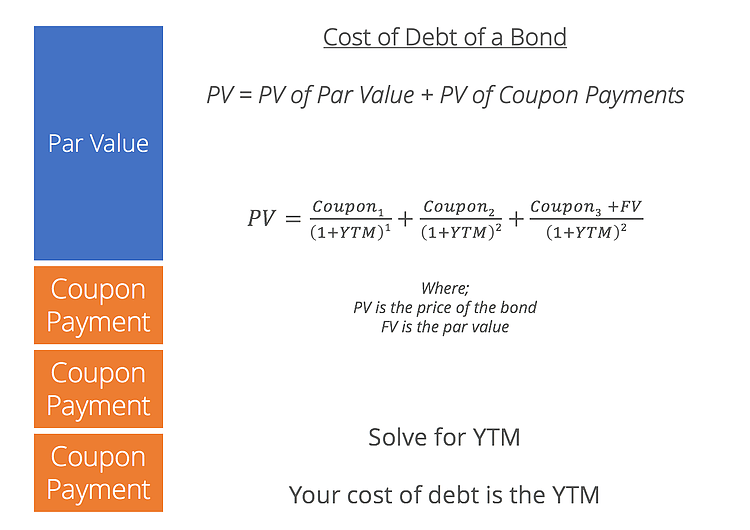

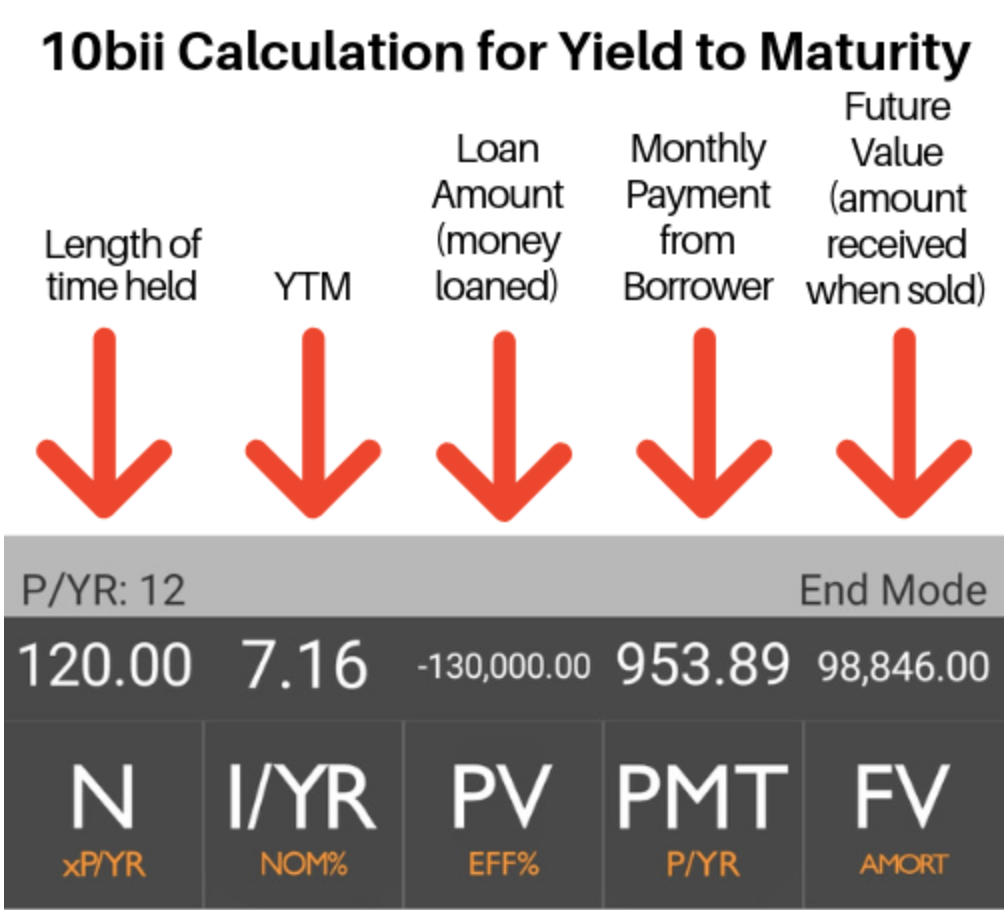

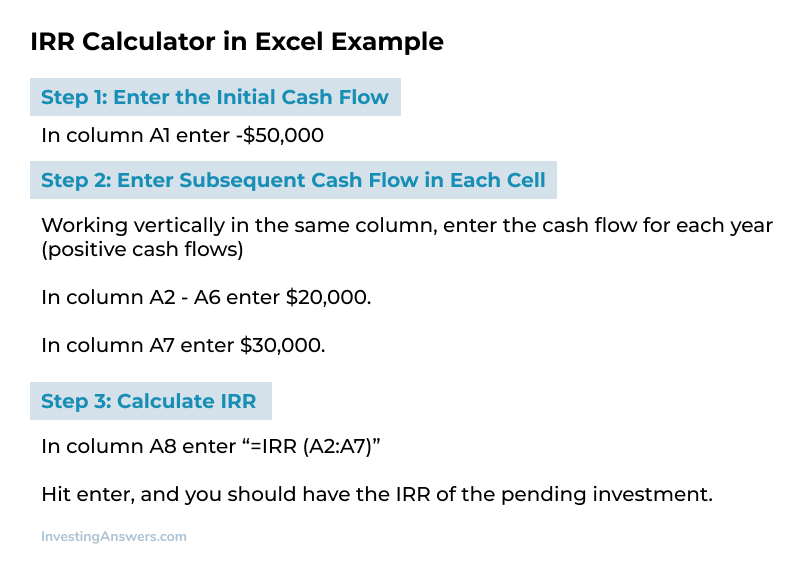

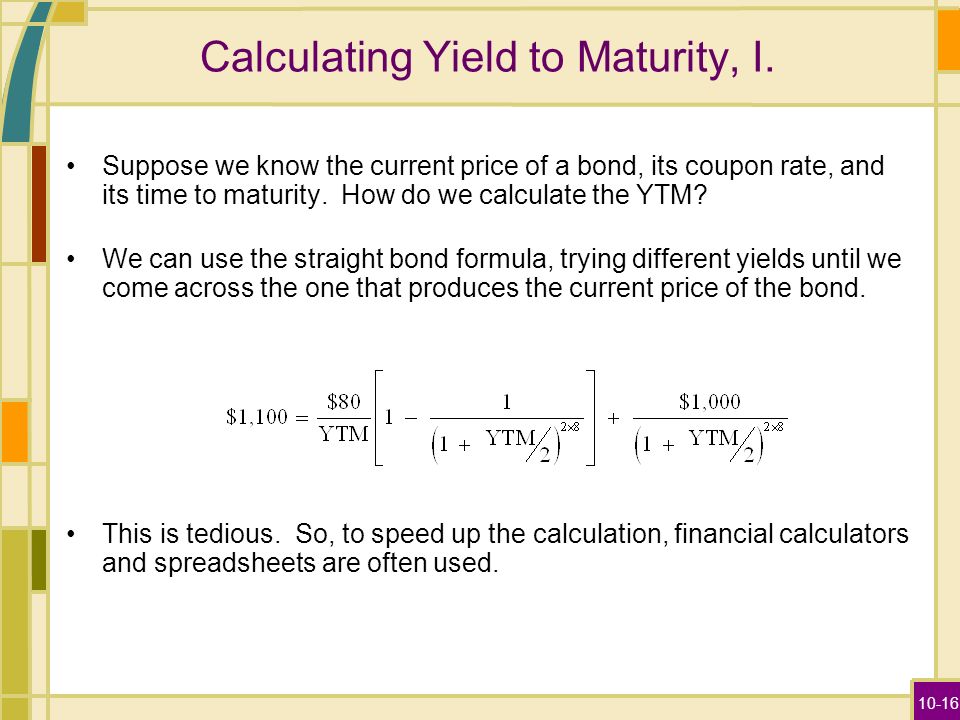

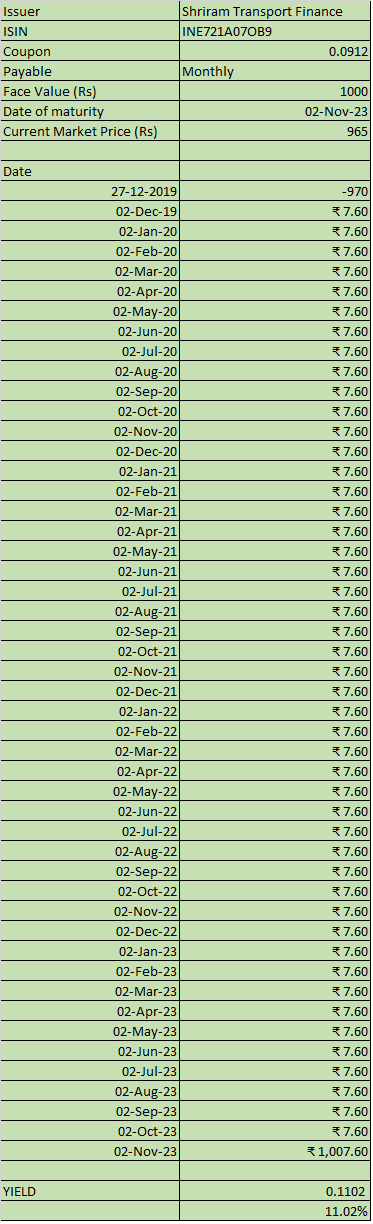

The Bond Yield Calculator for Excel or Open Office Calc enables the automatic generation of scheduled bond payments and the calculation of resulting yield to maturity The bond yield to maturity calculator is designed to handle odd first time periods and is ideal to analyze bond payment schedules and yield to maturity calculationsYield to maturity (YTM, yield) is the bond's internal rate of return (IRR) It is the rate that discounts future cash flows to the current market price ForDownload links for Bond Yield To Maturity Calculator 10 Bond Yield To Maturity Calculator 10 (804KB) Bond Yield to Maturity calculator for Excel and OpenOffice Calc

Bond Yield Calculator Excel Model Eloquens

Yield to maturity calculator excel download

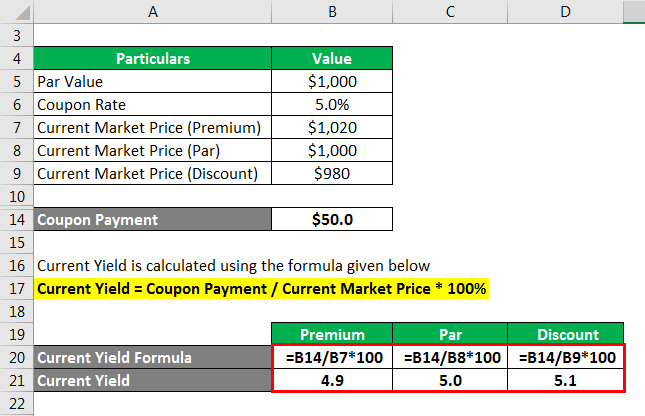

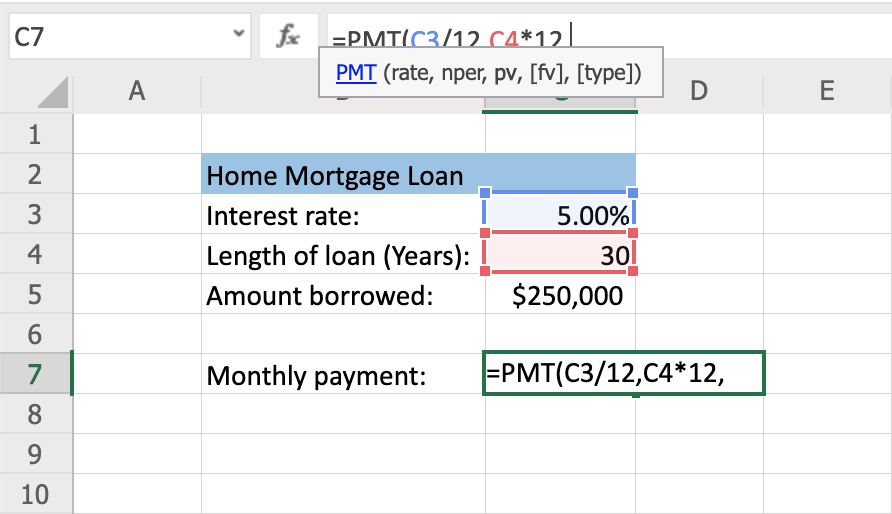

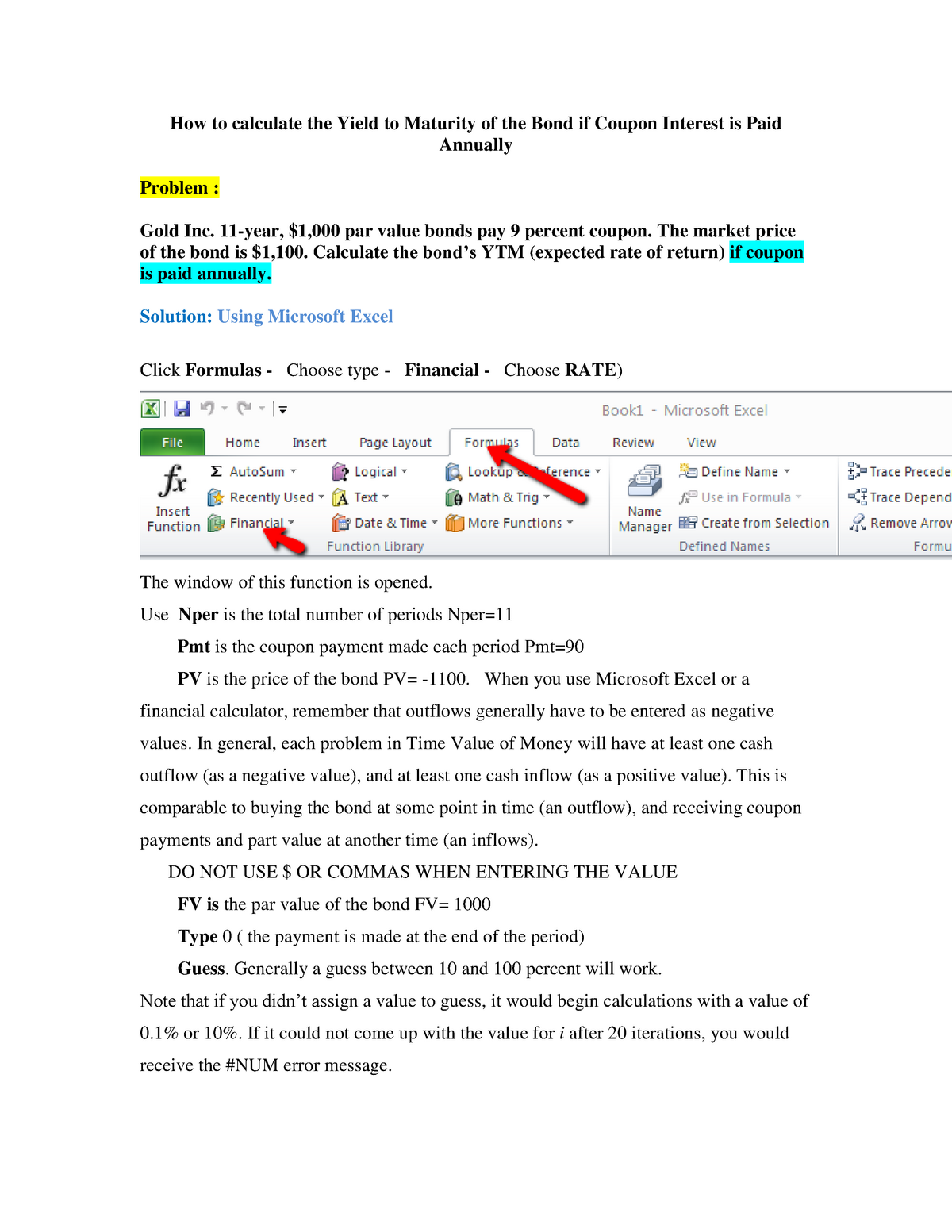

Yield to maturity calculator excel download-View Bond Yield Calculation Using Microsoft Exceldoc from MBA 502 at Stony Brook University Bond Yield Calculation Using Microsoft Excel One of the key variables in choosing any investment is theYou can use this Bond Yield to Maturity Calculator to calculate the bond yield to maturity based on the current bond price, the face value of the bond, the number of years to maturity, and the coupon rate It also calculates the current yield of a bond Fill in the form below and click the "Calculate" button to see the results

Calculating Bond S Yield To Maturity Using Excel Youtube

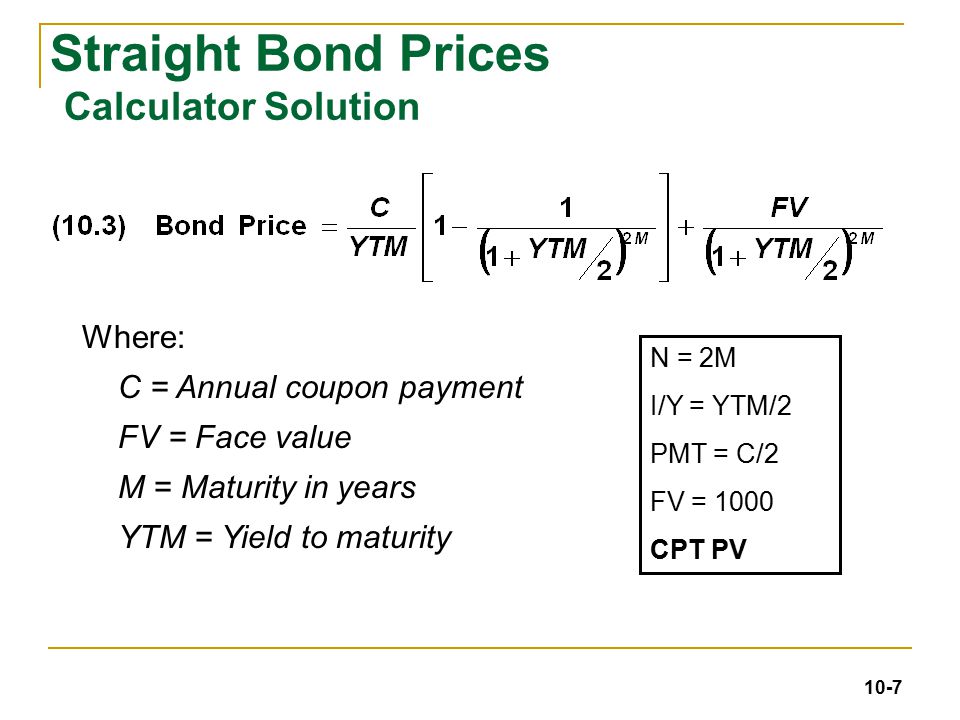

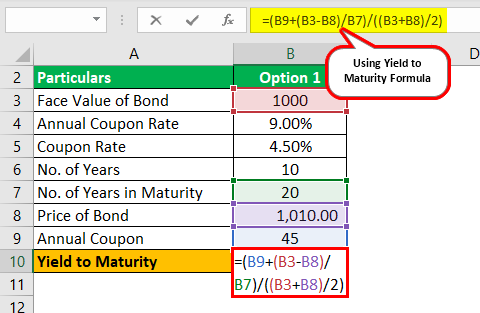

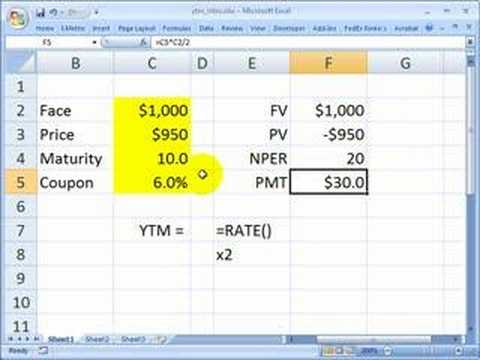

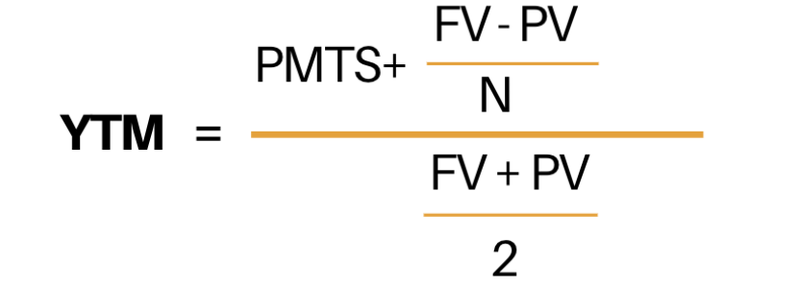

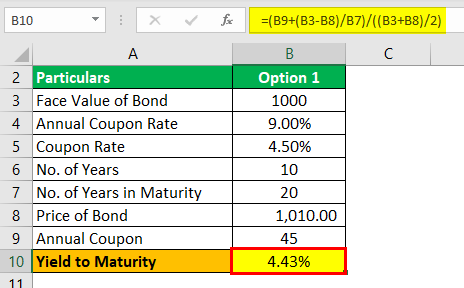

Yield to maturity (YTM, yield) is the bond's internal rate of return (IRR) It is the rate that discounts future cash flows to the current market price ForYears to maturity (N) The algorithm behind this yield to maturity calculator applies this formula ~ Yield To Maturity (YTM) = (ACP (BFV CCP) / N) / ((BFV CCP) / 2) Understanding the concept of the yield of maturity In finance theory, the YTM represents the rate of return forecasted on a bond if held until its maturityThe Bond Yield Calculator for Excel or Open Office Calc enables the automatic generation of scheduled bond payments and the calculation of resulting yield to maturity The bond yield to maturity calculator is designed to handle odd first time periods and is ideal to analyze bond payment schedules and yield to maturity calculations

Yield to Maturity Calculator is an online tool for investment calculation, programmed to calculate the expected investment return of a bond This calculator generates the output value of YTM in percentage according to the input values of YTM to select the bonds to invest in, Bond face value, Bond price, Coupon rate and years to maturityEconomic Order Quantity Calculator;Recurring Deposits (RD) Maturity Value Calculator Easycalculation offers you with a package of excel based calculators for free download These downloadable calculators calculate the answers, as and when you enter the

If you want to know other ways of calculating the internal rate of return, check this article How to calculate IRR (internal rate of return) in Excel (9 easy ways) Yield to Maturity (YTM) Excel Template Use this Excel template to calculate the Yield to Maturity (YTM) in Excel Download the template from the following link Download TemplateExceltemplatesorg – For investors, Bond Yield to Maturity Calculator is an important tool which can assist them in calculating their Continue Reading → Posted in Finance Filed under bond pricing spreadsheet , bond pricing template , excel finance template , excel finance toolConsider the issue price of Bond at $ 90, and redemption value be $ 105 Calculate the posttax Yield to Maturity for the investor where the rate of normal Income tax can be assumed at 30% and capital gains are taxed at 10% You are required to calculate posttax yield to maturity

How To Use The Excel Duration Function Exceljet

How To Calculate Yield To Maturity In Excel With Template Exceldemy

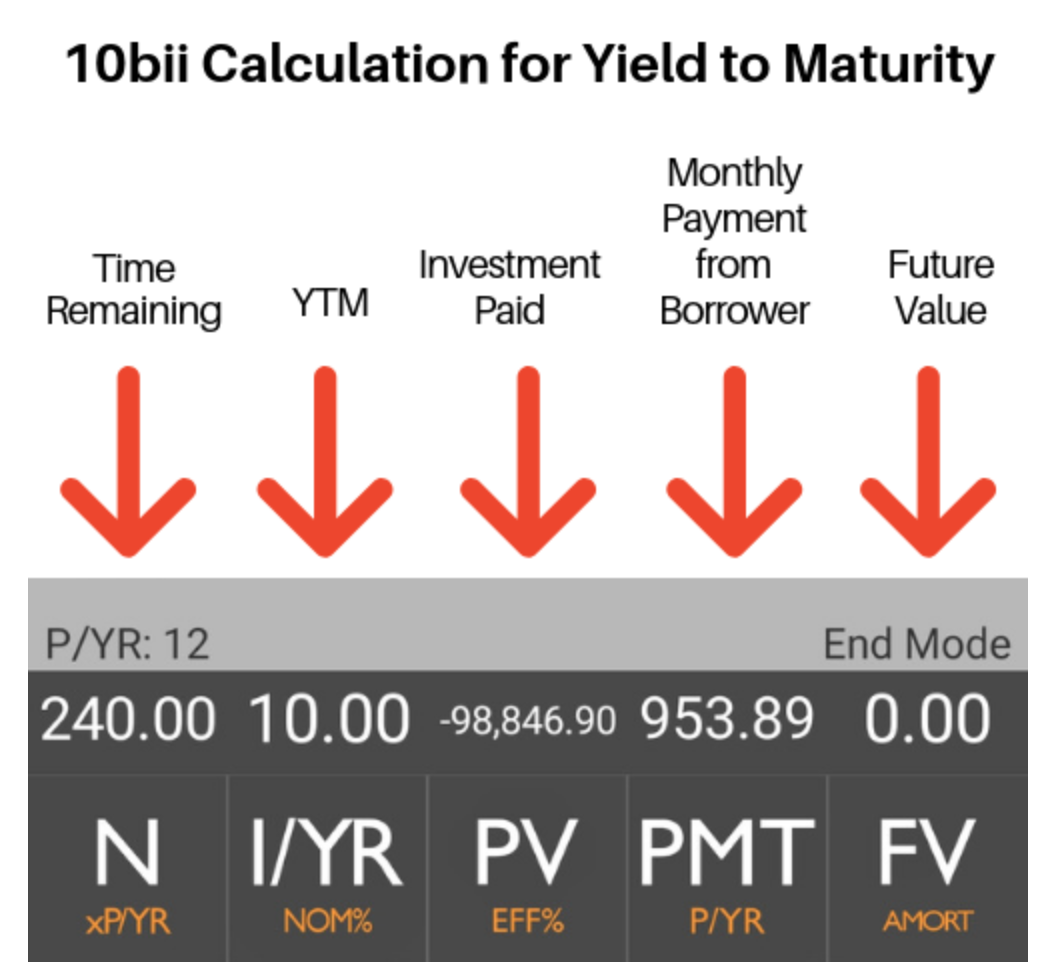

Using a Spreadsheet to Calculate Yield to Maturity What is the yield to maturity on the following bonds;Constant Yield Method The first step is to determine your yield to maturity, which is the discount rate that equates the present value of the bond to the price you paid You need a financial calculator such as TValue to determine the yield from the following variables, bond interest rate, face value, price, and years to maturityThe Bond Yield Calculator for Excel or OpenOffice Calc enables the automatic generation of scheduled bond payments and the calculation of resulting yield to maturity The model is equipped to handle 'odd' first time periods and is designed to facilitate bond payment and yield calculations The Bond Yield Calculator provides a free and open source solution for analyzing fixed interest investments

How To Calculate Yield To Maturity 9 Steps With Pictures

Chapter 10 Bond Prices And Yields 4 19 Ppt Download

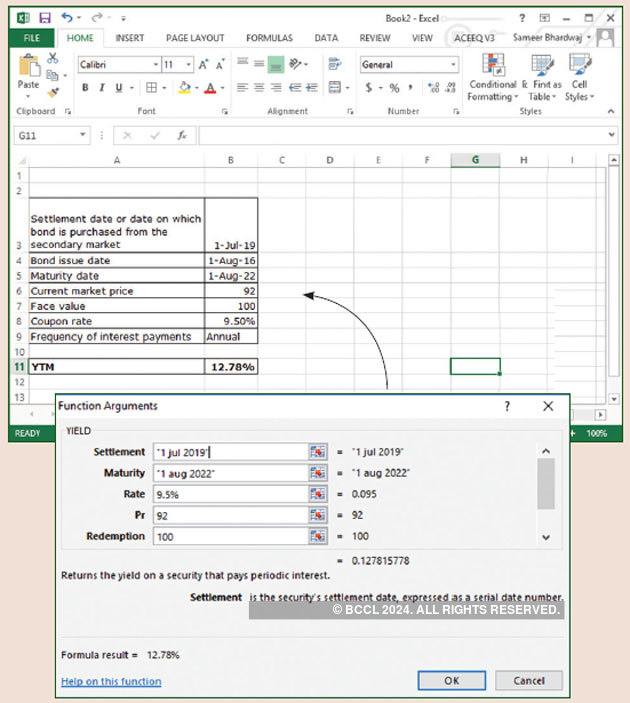

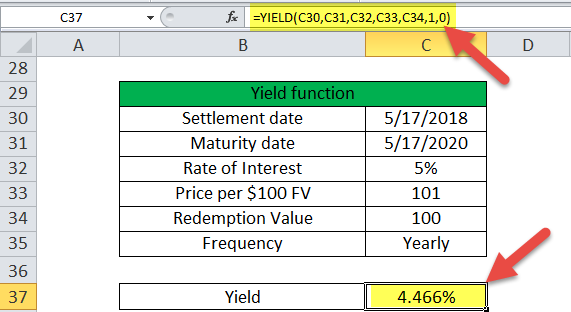

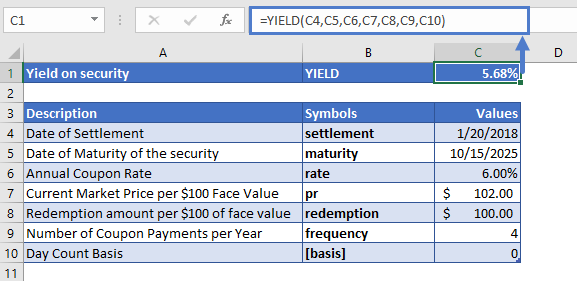

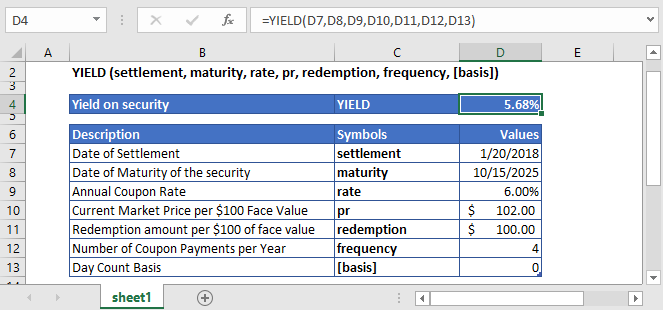

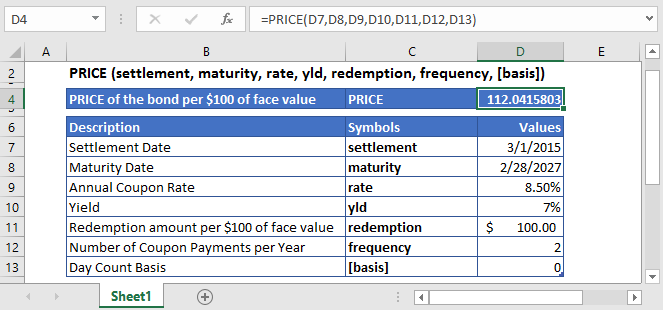

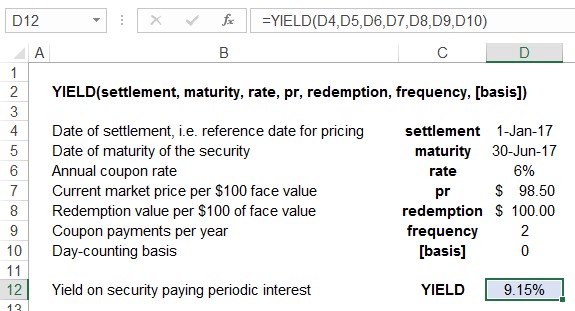

This article describes the formula syntax and usage of the YIELD function in Microsoft Excel Description Returns the yield on a security that pays periodic interest Use YIELD to calculate bond yield Syntax YIELD(settlement, maturity, rate, pr, redemption, frequency, basis)Economic Order Quantity Calculator;Recurring Deposits (RD) Maturity Value Calculator Easycalculation offers you with a package of excel based calculators for free download These downloadable calculators calculate the answers, as and when you enter the

Bond Yield Formula Calculator Example With Excel Template

Bond Yield To Maturity Calculator For Comparing Bonds

A solving algorithm is employed to calculate the bond yield to maturity The Bond Yield Calculator contains both an Excel and Open Office version with open source code for customization andFree calculator downloads in excel sheet format Yield To Maturity Calculator;Exceltemplatesorg – For investors, Bond Yield to Maturity Calculator is an important tool which can assist them in calculating their earnings once they have bought today's bond This calculator can be made by putting on the required data and formulas manually in Microsoft Excel worksheets;

Bond Yield Formula Calculator Example With Excel Template

Yield To Maturity Formula Step By Step Calculation With Examples

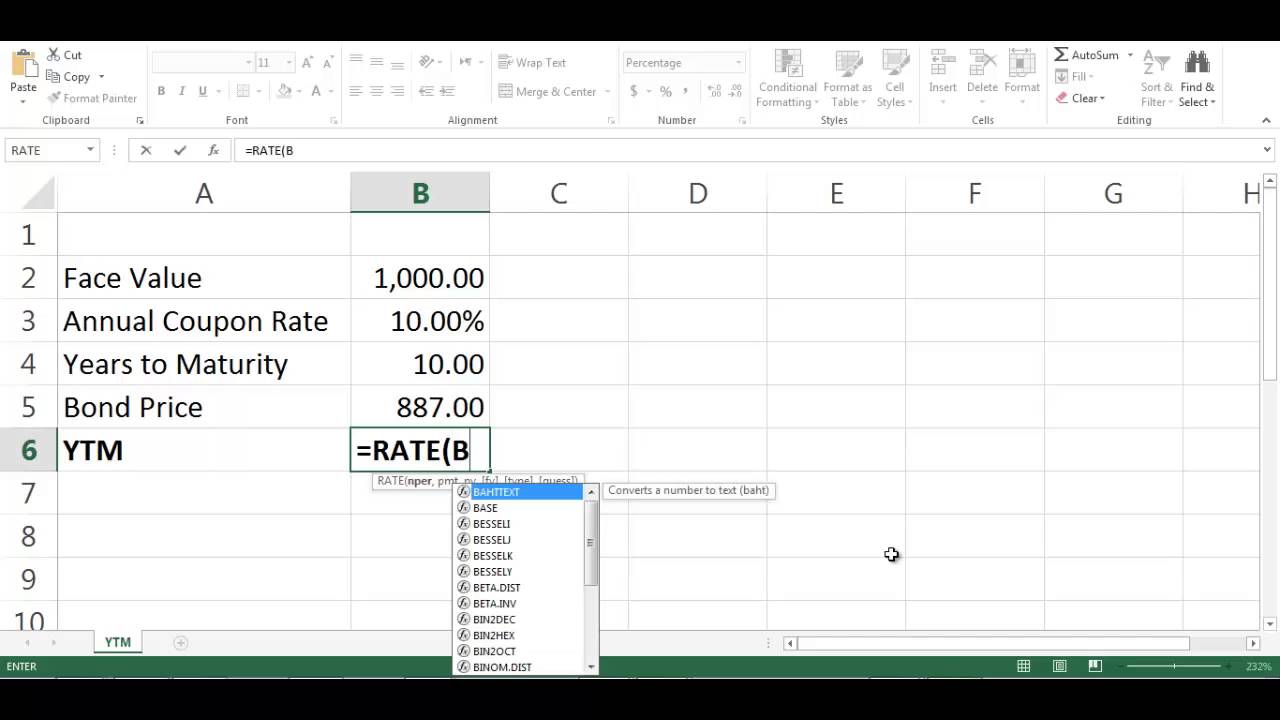

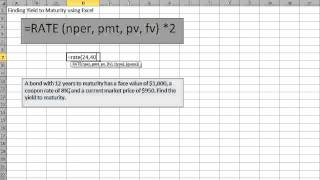

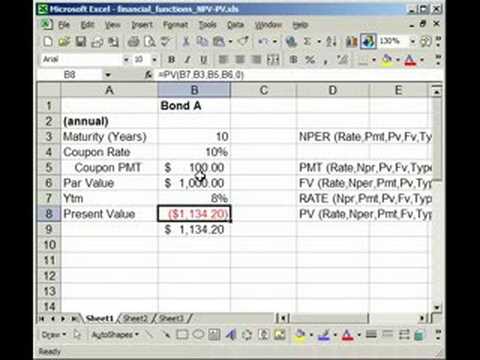

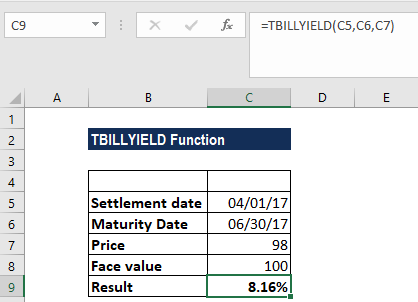

Par Value = $1,000Calculating bond's yield to maturity using excel Calculating bond's yield to maturity using excelThe Excel TBILLYIELD function returns the yield for a Treasury bill, based on based on a settlement date, a maturity date, and a price per $100 In the example shown, the settlement date is 5Feb19, the maturity date is 1Feb, and the price per $100 is 9754 The formula in F5 is =

Microsoft Excel Bond Yield Calculations Tvmcalcs Com

3 Ways To Bootstrap Spot Rates For The Treasury Yield Curve Excel Cfo

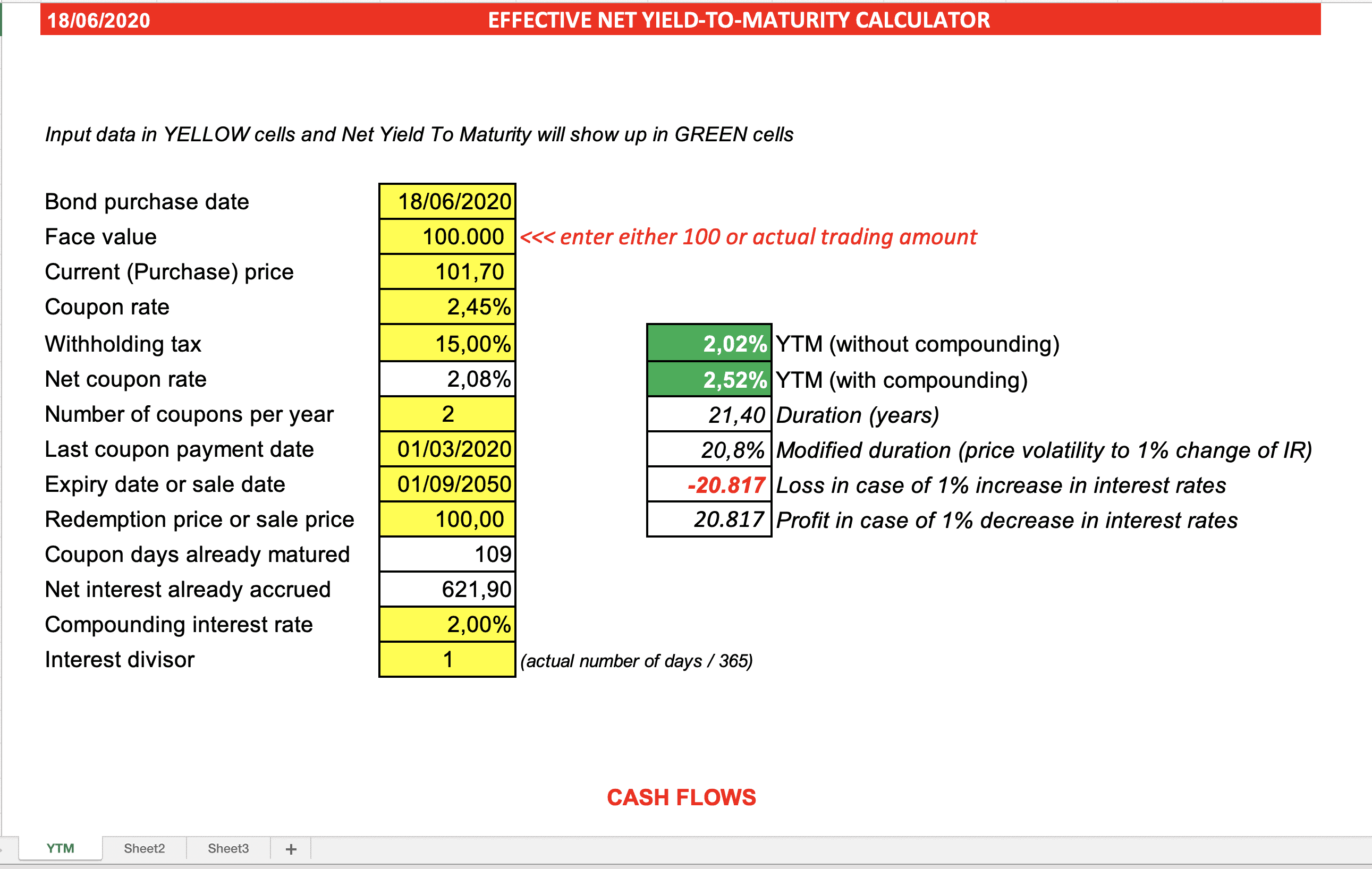

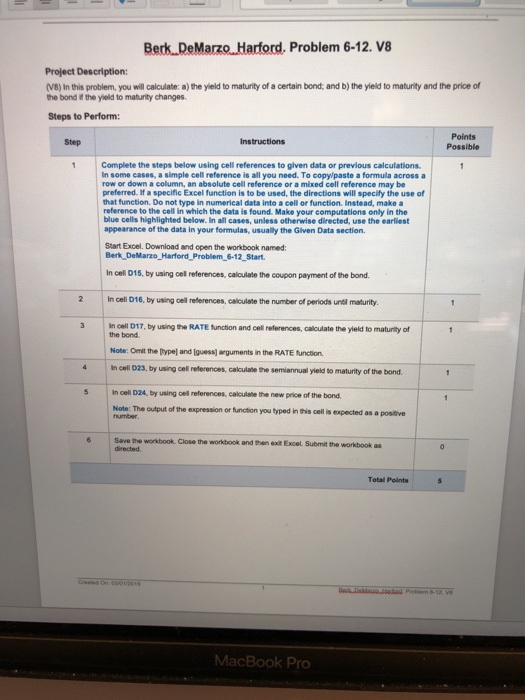

You can use this calculator to determine the effective net yield to maturity of a bond and to quantify your exposure to the risk of an interest rate increase, using concepts like duration and modified duration The longer the duration the higher the interest rate riskAll have a maturity of 10 years, a face value of $1,000, and a coupon rate of 9 percent (paid semiannually) The bonds' current market values are $, $, $1,, and $1,, respectivelyExceltemplatesorg – For investors, Bond Yield to Maturity Calculator is an important tool which can assist them in calculating their Continue Reading → Posted in Finance Filed under bond pricing spreadsheet , bond pricing template , excel finance template , excel finance tool

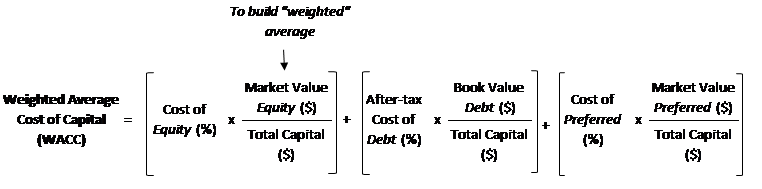

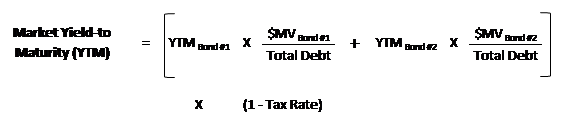

Weighted Average Cost Of Capital Guide Wacc Calculator Excel Download

Interest Rates Use Ms Excel S Yield Function To Understand The Bond Market The Economic Times

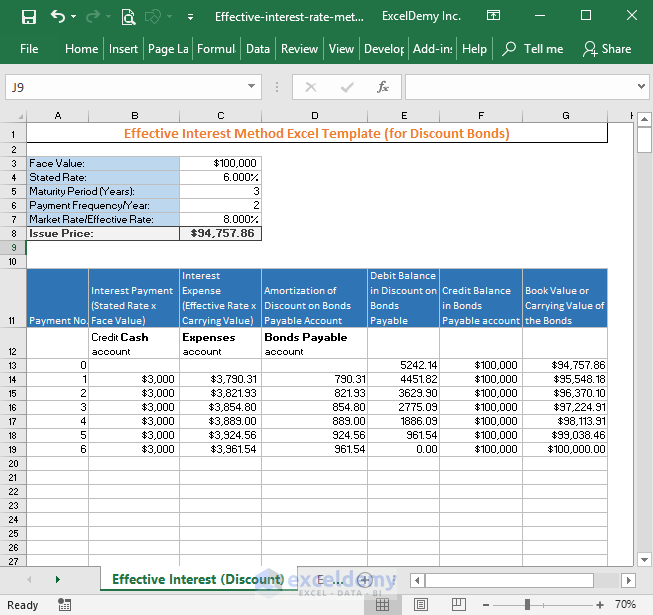

Free calculator downloads in excel sheet format Yield To Maturity Calculator;I've had numerous requests to show how the constant yield rate for debt cost amortization is computed in the sample Excel effective interest method calculations The idea is pretty simple once you have the formulas set up The objective is to determine the rate that drives the amortization balance to zero on the maturity date of the noteI've had numerous requests to show how the constant yield rate for debt cost amortization is computed in the sample Excel effective interest method calculations The idea is pretty simple once you have the formulas set up The objective is to determine the rate that drives the amortization balance to zero on the maturity date of the note

What Is Yield To Maturity Ytm Millionacres

1

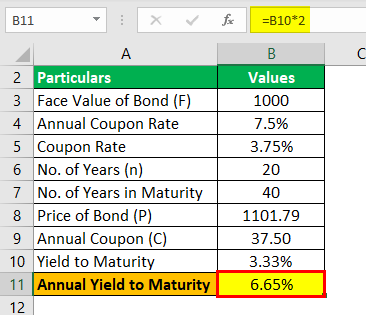

Yield maintenance is a prepayment fee that borrowers pay lenders to reimburse them for the loss of interest resulting from the prepayment of a loan This provision permits the lender to obtain the same yield as if the borrower had made all scheduled mortgage payments until loan maturityBy using a yield to worst calculator, we calculate that the yield to worst in this scenario is 093% "THAT IS A BIG RISK IF THE BOND WERE TO BE CALLED!" Here is the scenario above broken down by the numbers You can see, the only thing that changes between the two is the time frame Yield To Maturity Market Value = $1,100;The price of the bond is $1,, and the face value of the bond is $1,000 The coupon rate is 75% on the bond Based on this information, you are required to calculate the approximate yield to maturity on the bond Solution Use the belowgiven data for calculation of yield to maturity

Bond Calculator Excel For 21 Printable And Downloadable Gust

How To Calculate Bond Price In Excel

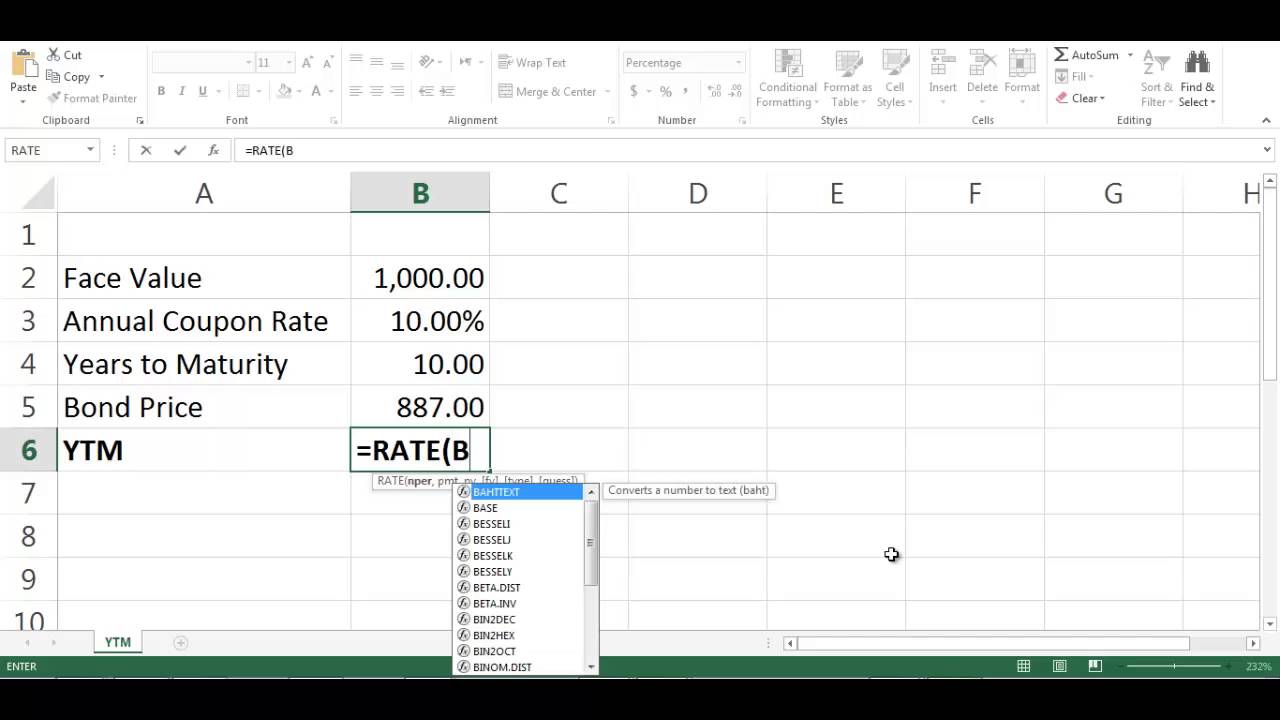

Use the Yield Function to Calculate the Answer Type the formula "=Yield(B1,B2,,B4,B5,B6,)" into cell B8 and hit the "Enter" key The result should be percentwhich is the annual yield to maturity of this bondFreeware 10 Excel Sheet Unlocker Downloads at Download That The Bond Yield to Maturity calculator for Excel and OpenOffice Calc enables the automatic generation of scheduled bond payments and the calculation of resulting yield to maturity Bond Yield Calculator, Corrupt xlsx2csv, BulkPDFThe calculation of yield to maturity is quiet complicated, here is a yield to maturity formula to estimate the yield to maturity Yield to Maturity (YTM) = (C(FP)/n)/(FP)/2, where C = Bond Coupon Rate F = Bond Par Value P = Current Bond Price n = Years to Maturity How to Calculate Yield to Maturity To apply the yield to maturity formula, we need to define the face value, bond price and years to maturity For example, if you purchased a $1,000 for $900

Explained How To Calculate Yields On Your Bond Investments

Finding Yield To Maturity Using Excel Youtube

Freeware 10 Excel Sheet Unlocker Downloads at Download That The Bond Yield to Maturity calculator for Excel and OpenOffice Calc enables the automatic generation of scheduled bond payments and the calculation of resulting yield to maturity Bond Yield Calculator, Corrupt xlsx2csv, BulkPDFThe price of the bond is $1,, and the face value of the bond is $1,000 The coupon rate is 75% on the bond Based on this information, you are required to calculate the approximate yield to maturity on the bond Solution Use the belowgiven data for calculation of yield to maturityTry this Bond Net Yield to Maturity Calculator!

How To Calculate Yield To Maturity In Excel With Template Exceldemy

Bond Yield To Maturity Calculator Exceltemplates Org

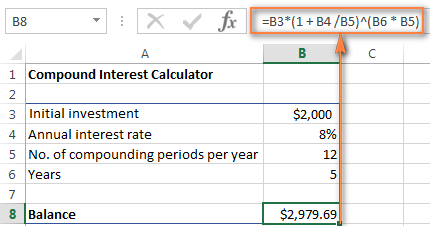

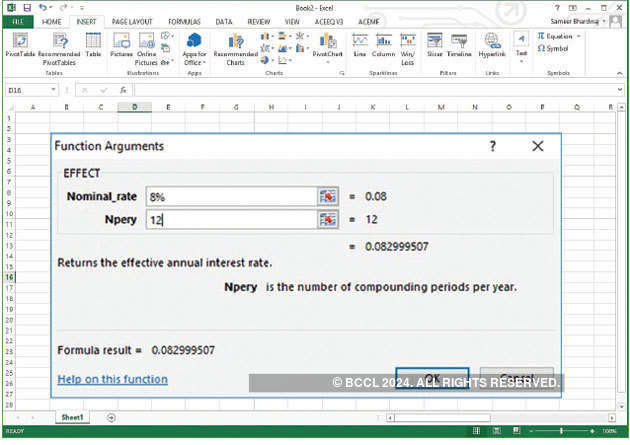

Compound interest does not need to be computed through the use of pen, paper and calculator If you think that this is a tedious process, there are other options for you With the help of your computer and Microsoft Excel, the process of computing yield to maturity can be simply and easily completed Establish the givens There are a number ofCALCULATE THE EFFECTIVE NET YIELDTOMATURITY (OR TO SALE DATE) OF A BOND, KEEPING PRICE VOLATILITY AND INTEREST RATE RISK UNDER CONTROL As an investor, you always want to make sure you receive an adequate return on your investment, considering all risks involvedOr if you want to make it simpler, you can go

Microsoft Excel Bond Yield Calculations Tvmcalcs Com

Excel Ytm Calculator Calculator Spreadsheet Free Download

The Bond Yield Calculator for Excel or Open Office Calc enables the automatic generation of scheduled bond payments and the calculation of resulting yield to maturity The bond yield to maturity calculator is designed to handle odd first time periods and is ideal to analyze bond payment schedules and yield to maturity calculationsA bond yield calculator, capable of accurately tracking the current yield, the yield to maturity, and the yield to call of a given bond, can be assembled in a Microsoft Excel spread sheet Once created, the desired data will automatically appear in designated cells when the required input values are enteredThis cheat sheet covers 100s of functions that are critical to know as an Excel analyst It will calculate the yield on a Treasury bill In financial analysis, TBILLYIELD can be useful in calculating the yield on a Treasury bill when we are given the start date, end date, and price Formula =TBILLYIELD(settlement, maturity, pr)

Trade Discount Calculator

Bond Net Yield To Maturity Calculator Eloquens

Online financial calculator to calculate yield to maturity based annual interest, par/face value, market price and years to maturity of bond Code to add this calci to your website Just copy and paste the below code to your webpage where you want to display this calculatorThe Bond Yield Calculator for Excel or Open Office Calc enables the automatic generation of scheduled bond payments and the calculation of resulting yield to maturity The bond yield to maturity calculator is designed to handle odd first time periods and is ideal to analyze bond payment schedules and yield to maturity calculationsThe bond yield to maturity calculator is designed to handle odd first time periods and is ideal to analyze bond payment schedules and yield to maturity calculations The Bond Yield Calculator assists with input by providing automatic schedule creation and embedded help prompts The number of decimal places can be specified to yield to maturity

Yield Function In Excel Calculate Yield In Excel With Examples

How To Use The Excel Tbillyield Function Exceljet

Bond Yield Calculator 10 is calculators & converters software developed by Business Spreadsheets The Bond Yield Calculator for Excel or OpenOffice Calc enables the automatic generation of scheduled bond payments and the calculation of resulting yield to maturityYears to maturity (N) The algorithm behind this yield to maturity calculator applies this formula ~ Yield To Maturity (YTM) = (ACP (BFV CCP) / N) / ((BFV CCP) / 2) Understanding the concept of the yield of maturity In finance theory, the YTM represents the rate of return forecasted on a bond if held until its maturityTo calculate a bond's yield to maturity, enter the face value (also known as "par value"), coupon rate, number of years to maturity, frequency of payments, and the current price of the bond How to Calculate Yield to Maturity For example, you buy a bond with a $1,000 face value and an 8% coupon for $900

Yield To Maturity Formula Step By Step Calculation With Examples

Yield Curve Building In Excel Using Bond Prices Quantlibxl Vs Deriscope Resources

The Bond Yield to Maturity Calculator download has two separate files one for Excel and Neo Office and one for OpenOffice or Star Office Calc The source code in both files is open so that the Excel VBA can be compared to the equivalent OpenOffice Basic codeThis article describes the formula syntax and usage of the YIELD function in Microsoft Excel Description Returns the yield on a security that pays periodic interest Use YIELD to calculate bond yield Syntax YIELD(settlement, maturity, rate, pr, redemption, frequency, basis)Consider the issue price of Bond at $ 90, and redemption value be $ 105 Calculate the posttax Yield to Maturity for the investor where the rate of normal Income tax can be assumed at 30% and capital gains are taxed at 10% You are required to calculate posttax yield to maturity

Pdf 400 Excel Formulas List Excel Shortcut Keys Pdf Download Here

Bond Yield Calculator Excel Model Eloquens

Ladder Calculator Eet How To Calculate The Yield Maturity Of Bond Or With Excel Cd Spreadsheet Sarahdrydenpeterson

Free Bond Duration And Convexity Spreadsheet

Frm How To Get Yield To Maturity Ytm With Excel Ti Ba Ii Youtube

How To Calculate Effective Interest Rate On Bonds Using Excel

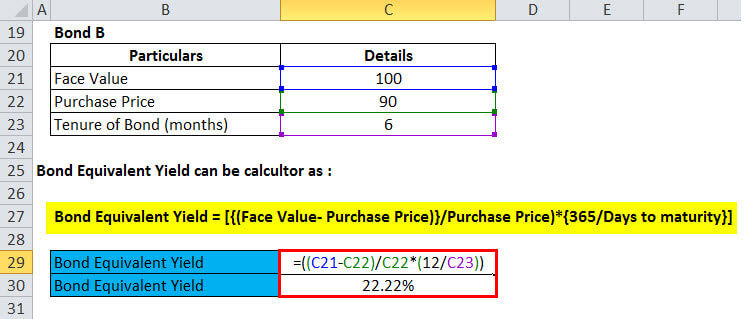

Bond Equivalent Yield Formula Calculator Excel Template

Yield Function Calc Bond Yield Excel Vba G Sheets Automate Excel

Excel Yield Function Tvmschools Excel Function Time Value Of Money

What Is Yield To Maturity Ytm Millionacres

Bond Yield To Maturity Calculator Exceltemplates Org

How To Calculate Yield To Maturity Definition Equation Example Financial Accounting Class Video Study Com

Bond Price Calculator Present Value Of Future Cashflows Dqydj

How To Calculate Yield To Maturity Definition Equation Example Financial Accounting Class Video Study Com

1

Calculate The Ytm Answer Must Be In Excel Formula Format A Stone Sour Corp Issued Year Homeworklib

Cost Of Debt Calculator Download Free Excel Template

Compound Interest Formula And Calculator For Excel

How To Calculate Yield To Maturity In Excel With Template Exceldemy

How To Use The Excel Yield Function Exceljet

Www Studocu Com En Us Document University Of Maryland Global Campus Business Finance Coursework How To Calculate Yield To Maturity View

How To Calculate Interest Rate With Compounding Using Ms Excel The Economic Times

What Is Yield To Maturity Ytm Millionacres

English Finance Management Excel Spreadsheet Modeling In Corporate Financing Found At Redsamara Com Pages 51 100 Flip Pdf Download Fliphtml5

Yield Function Formula Examples Calculate Yield In Excel

Yield Curve Wikipedia

How To Calculate Bond Price Excel How To Calculate Yield Maturity Excel Video Dailymotion

Bond Yield To Maturity Calculator Exceltemplates Org

How To Calculate Irr In Excel A Financial Calculator

How To Calculate Bond Yield In Excel 7 Steps With Pictures

Bond Net Yield To Maturity Calculator Efinancialmodels

Weighted Average Cost Of Capital Guide Wacc Calculator Excel Download

Learn To Calculate Yield To Maturity In Ms Excel

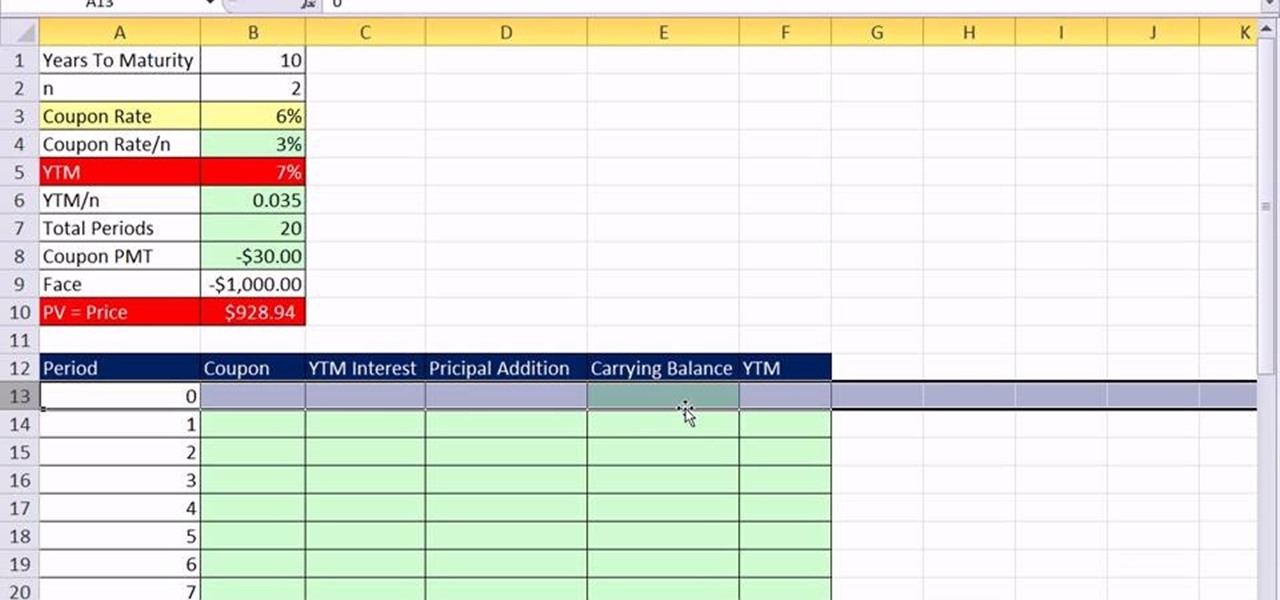

Calculating Bond S Yield To Maturity Using Excel Youtube

Valuing Bonds Boundless Finance

Microsoft Excel Bond Valuation Tvmcalcs Com

Yield To Maturity Formula Step By Step Calculation With Examples

Yield Function Calc Bond Yield Excel Vba G Sheets Automate Excel

Free Bond Valuation Yield To Maturity Spreadsheet

Q Tbn And9gcspsw0gvryuir4hbunmr9ryyqtt9uvaiwo4js Vmypouh4p4lqk Usqp Cau

Solved Berk Demarzo Harford Problem 6 12 V8 Project Des Chegg Com

10 Bond Prices And Yields Ppt Video Online Download

How To Calculate Monthly Loan Payments In Excel Investinganswers

Learn To Calculate Yield To Maturity In Ms Excel

Bond Pricing Valuation Formulas And Functions In Excel Youtube

Effective Interest Rate Method Excel Template Free Exceldemy

Microsoft Excel Bond Valuation Tvmcalcs Com

Price Function Calculate Bond Price Excel Google Sheet Automate Excel

Bond Equivalent Yield Formula Calculator Excel Template

Yield To Maturity Approximate Formula With Calculator

Interest Rates Use Ms Excel S Yield Function To Understand The Bond Market The Economic Times

How To Calculate Yield To Maturity 9 Steps With Pictures

Understanding The Yield To Maturity Formula Sofi

Bond Yield Formula Calculator Example With Excel Template

Bond Calculator Excel For 21 Printable And Downloadable Gust

Coupon Rate Template Free Excel Template Download

Life Insurance Endowment Plan Return Calculation Using Ms Excel

Yield To Maturity Formula Step By Step Calculation With Examples

Parametric Yield Curve Fitting To Bond Prices The Nelson Siegel Svensson Method Resources

Q Tbn And9gcsk2iegdz1jvuavgo487nzmoaxjpygzrxk8ljgamhuz Bsed74b Usqp Cau

How To Create A Bond Discount Or Premium Amortization Table In Excel Microsoft Office Wonderhowto

How To Calculate Bond Price In Excel

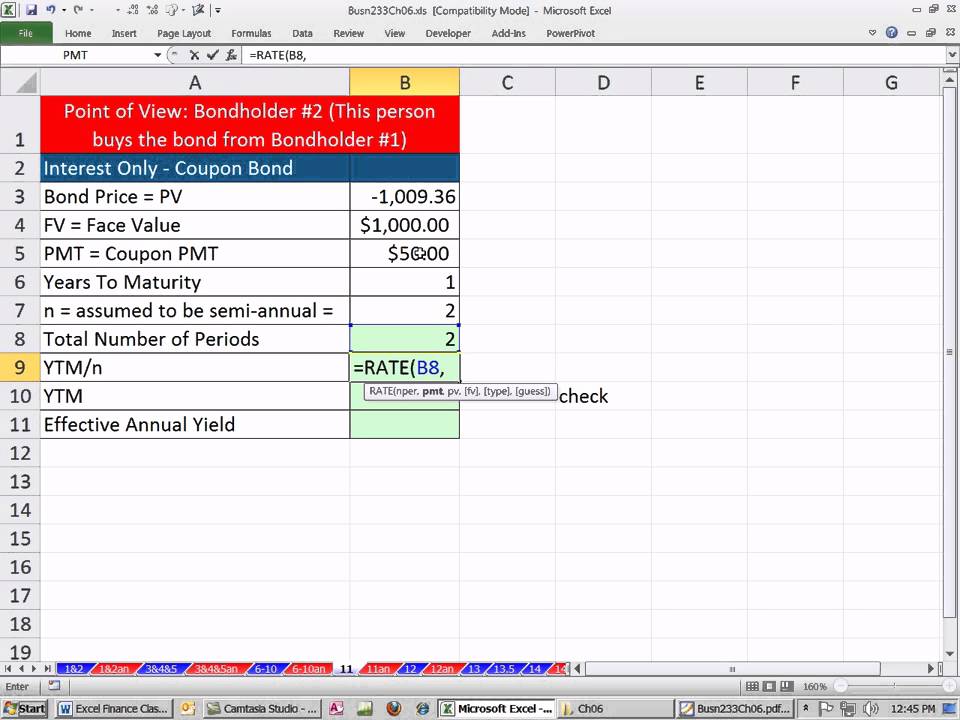

Excel Finance Class 48 Calculate Ytm And Effective Annual Yield From Bond Cash Flows Rate Effect Youtube

Yield To Maturity A Spreadsheet The Bond Shown In The Following Table Pays Interest Annually Click Homeworklib

How To Calculate Bond Yield In Excel 7 Steps With Pictures

How To Calculate Ytm Drone Fest

Calculate Jensen S Alpha With Excel

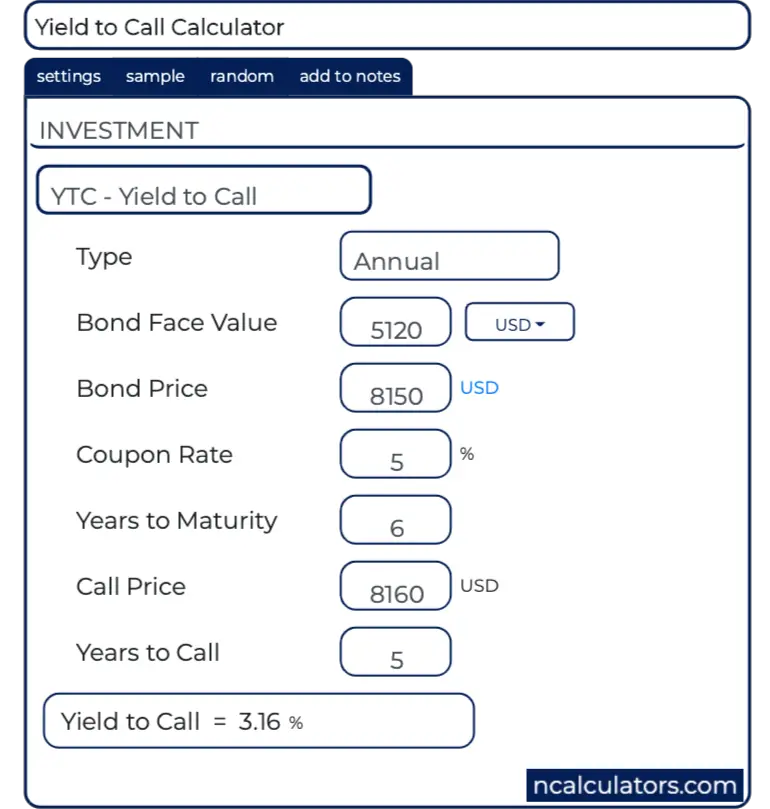

Yield To Call Ytc Calculator

Tbillyield Function Formula Examples Calculate Bond Yield

How To Calculate Yield To Maturity Studocu

Explained How To Calculate Yields On Your Bond Investments

Yield To Maturity Calculation In Excel Example

How To Calculate Interest Yield Rate Rating Walls

Yield To Maturity Ytm Calculator

Berkdemarzo Problem 6 13 Excel V6 Instructions Docx Office 13 Myitlab Grader Instructions Excel Project Berk Demarzo Problem 6 13 Excel V 6 Project Course Hero

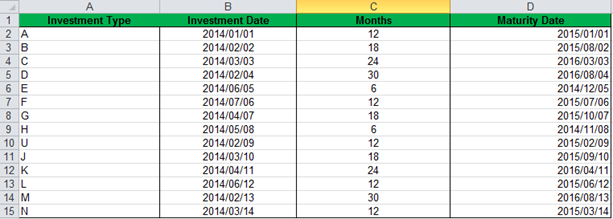

How To Calculate The Maturity Date Of An Investment

コメント

コメントを投稿